- Crypto Casinos

- Bitcoin Games

- Reviews

- Learn

- Essentials

- Are Bitcoin Casinos Legal?

- Crypto Wallets for Gambling

- VPN for Bitcoin Casinos

- What is RTP?

- Gambler’s Fallacy

- Deposit with Credit Card On Bitcoin Casino

- Bankroll Management

- How To Play Bingo

- What Casino Game Has the Best Odds

- Best Casino Game To Win Money

- How VIP Programs Work

- RNG in Casinos

- Slot Machine Odds

- How Free Spins Work

- Poker Cheat Sheet

- Guides

- How to Play Texas Holdem Poker

- How to Play Three Card Poker

- How to Play Pai Gow Poker

- How To Play Omaha Poker

- How to Play Caribbean Stud Poker

- How to Play Seven Card Stud

- How to Play Mississippi Stud Poker

- Poker Odds Guide

- Card Counting in Blackjack

- What is a Blackjack Split

- What is a Push in Blackjack

- Roulette Wheel Explained

- How to Play Craps

- Craps Odds Explained

- Craps Come Bet

- How to Play Baccarat

- Moneyline Betting Explained

- Arbitrage Betting Explained

- How Sportsbetting Betting Odds Work

- Video Poker Odds

- Limit vs No Limit Poker

How to Sell Bitcoin: Top 5 Ways To Cash Out Your Crypto

Venturing into the cryptocurrency world is fairly straightforward for those looking to buy Bitcoin. But when it comes to selling, you have to know the right time to sell cryptocurrency and trade in your crypto for cash. This guide will teach you just that, taking you through the basics of how to sell Bitcoin.

Say you just withdrew your winnings from your favorite crypto casino. How do you convert these digital tokens into traditional fiat currency that can you can use for your everyday needs and transactions?

Selling the Bitcoins online can be done in several ways. There are direct trades, peer-to-peer marketplace, or even selling through a popular crypto exchange. Bitcoin ATMs are another convenient solution, that are now widely available to help with selling cryptocurrency.

Irrespective of your status as an investor, mastering the art of selling Bitcoin and how to trade Bitcoin is a skill that can open various doors of opportunity.

Thankfully, here at Bitcoincasinos, we not only show you the best crypto casinos on the market but also provide comprehensive guides for you. Taking you through the ins, outs, pros, and cons of selling Bitcoin confidently. So, let’s delve right into it!

Top 5 Ways to Sell Bitcoin: Cashing Out Your Crypto

In this guide, we will explore the top five ways to sell your Bitcoin effectively. Note that before you can start selling your crypto earnings or Bitcoin casino winnings, you will have to withdraw the tokens from your gambling account into a secure wallet.

The ways to sell include:

Comprehensive Guide On How To Sell Bitcoin

-

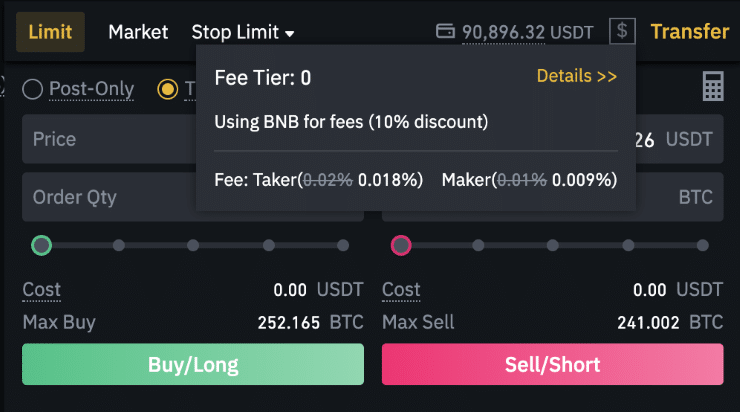

Exchanges

When it comes to trading Bitcoin, crypto exchanges have long been a go-to option, offering convenience (most are available on mobile), despite a few drawbacks. These platforms act as intermediaries, holding both the seller’s and buyer’s funds. It is also easy to learn how to sell Bitcoin on Coinbase, Binance, or any other popular exchange.

To start your trading journey, register and create an account on a reputable cryptocurrency exchange. The verification process is a standard feature in trustworthy crypto exchanges. This will typically involve linking a bank account and undergoing identity verification.

Afterward, it would be best to determine your desired price and set an “offer to sell crypto” in a chosen cryptocurrency. Once a compatible buyer matches your terms, the crypto exchange handles the transaction seamlessly, leaving you with a successful trade.

Post-transaction, there’s the matter of transferring the funds to your linked bank account. However, be prepared for possible delays, since some banks have a more tedious process when dealing with crypto-related transfers. Partnering with a crypto-friendly bank can smooth this process.

It’s also important to note that you may need to pay a transaction fee, although they are generally reasonable. Every exchange holds its fee structure, so scrutinizing this aspect before choosing one is advisable.

One crucial aspect is the storage limit that exchanges would impose. While this might evolve as you gain experience on a particular area platform, you must note that storing your assets within an exchange can pose risks.

Past exchange hacks and shutdowns highlight the importance of securing your funds. If immediate access is unnecessary, consider securing your coins in an offline or cold wallet for enhanced security. Luckily, most exchanges have in-built wallet services that can also hold funds transferred from your crypto gaming profile.

Exchange Currency Selling Fees Bank Transfer Withdrawal Fee Credit Card Withdrawal Fee Coinbase Bitcoin, Ethereum, Pound Sterling, US Dollar, Euro etc. (179 total) 1.49% €0.15 or 1.49% N/A Binance More than 600 for global traders, and more than 100 for U.S. investors 0.5% 1.8% 1.8% Kraken Ethereum, Bitcoin, Ripple, Stellar/Lumens, Zcash, Ethereum Classic, Augur, Iconomi, Monero, Euro, US Dollar, Japanese Yen, Canadian Dollar, Pound Sterling 0% – 0.36% 0% – 0.19% Or a fixed commission figure

N/A Bitstamp Bitcoin, Ripple, Euro, US Dollar 0.1% – 0.25% €0.09 or 0.9% 0.0% – 0.50% – based on withdrawal amount A comprehensive list of exchange fees for the most widely known crypto exchanges like Binance, Coinbase, etc., can be found on places like CoinMarketCap or Investopedia.

Pros

- With a custodial wallet, you can easily sell

- Convenient for gambling enthusiasts with wallets

- Sellers have a wide option of exchanges to choose from

- It’s faster than P2P trading

Con

- Requires a bank account

-

Direct Trades

If you prefer direct interaction with buyers instead of relying on a crypto exchange, platforms designed for direct trading might be the perfect fit for you.

After registering on a platform that offers direct trades, the next step is to verify your identity— a standard step post-registration. However, unlike exchanges, these platforms function as facilitators, where you essentially “advertise” your sale.

Like the exchange route, you sell your Bitcoin by posting an offer similar to a classified ad, indicating your price. When a potential buyer expresses interest in a direct trade with you, you receive a notification. Then, you can communicate and negotiate with the buyer, bypassing the third-party role of an exchange.

However, bear in mind that opting for direct trading is more time-consuming compared to the process of an exchange platform. Patience is a virtue, they say. So, be sure to conduct thorough research before choosing a website.

Wallets also come in handy here, as they will hold the crypto you’ve withdrawn from a casino like Mega Dice before you decide to sell.

Among the multitude of platforms that also offer direct trading to users, you will find sites like Coinbase and eToro amongst others.

Pros:

- Feels more personal and secure

- Instant as sellers confirm remittance before giving crypto

- Sellers can select preferred and trusted buyers to sell to

Cons:

- More time-consuming than exchanges

-

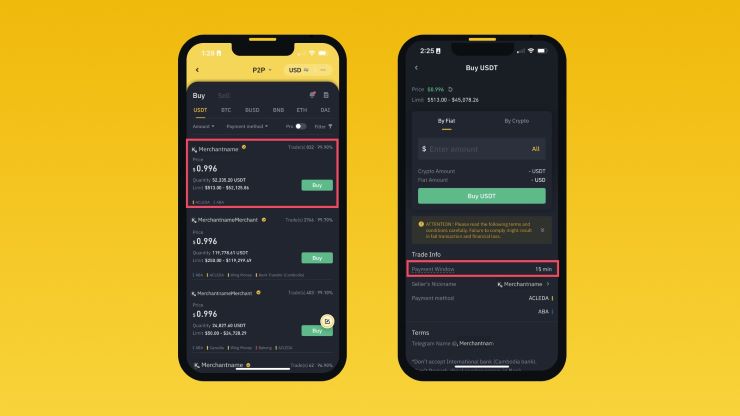

P2P Trading

Peer-to-peer trading is a new concept in the cryptocurrency world, distinct from traditional exchanges. It doesn’t require direct fund exchange; instead, it creates a digital space where individuals with differing but equivalent needs come together, facilitated by a website.

The P2P concept intends to bridge two unique cases: individuals looking to buy Bitcoins or other cryptocurrencies and those aiming to use their Bitcoins for purchases where traditional payment methods are typically accepted.

In essence, P2P trading websites offer buyers a secure and reliable service that not only guarantees successful transactions but also offers users a dedicated wallet to store cryptocurrency holdings.

Imagine it as a sort of Facebook marketplace but with an added layer of security provided by the P2P trading website. Let’s say you stumble upon a Reddit post where someone expresses interest in buying cryptocurrency, and coincidentally, you want to sell crypto or Bitcoins.

Now, the catch with Reddit is that it isn’t a dedicated P2P platform, so the security of the transaction isn’t guaranteed. However, if both parties register on a P2P site, the seller can add an offer, and the buyer can buy it through the platform’s marketplace.

Once the Bitcoins have been delivered successfully, the marketplace releases the funds securely into the seller’s account. You must note that these platforms also offer the opportunity to showcase items like artwork and clothing, extending the utility to goods beyond cryptocurrency transactions. While it may be expensive, its convenience significantly simplifies the process.

It is noteworthy that the services mentioned above operate in the realm of online-based decentralized solutions. This means that users must go through a comprehensive verification procedure, erasing the anonymity associated with cryptocurrency trading. Some of the most established P2P platforms include OpenBazaar and Binance P2P.

But what it takes in anonymity, it gives back in convenience, as most P2P offering platforms also have wallets that can easily receive and house your crypto from DeFis and crypto casinos. And then hold those tokens till you’ve found a buyer for P2P.

Upon completing a sale, you must initiate a bank transfer; which means a withdrawal to your bank account. However, this can be time-consuming and incurring additional costs. Additionally, many Bitcoin sellers tend to prefer offline trading options.

Pros

- Lower fees than cash conversion on a centralized exchange account

- Wallets hold crypto winnings till you’re ready to sell

- Sellers can negotiate to get the most money for their crypto

Con

- Requires a bank account

-

Bitcoin ATMs

Although Bitcoin ATMs resemble regular ATMs, their technological prowess significantly surpasses that of the traditional cash machine. Instead of connecting to a bank account, a Bitcoin ATM links you to the internet, facilitating seamless Bitcoin transactions.

These machines accept fiat currencies and convert them into Bitcoins, often delivering them through a QR code, a paper receipt, or a direct transfer to your Bitcoin wallet. It is noteworthy that the convenience of a Bitcoin ATM has a drawback–the cost. While the expense might be a downside, it is essentially a trade-off for its added convenience.

You must know that Bitcoin ATMs aren’t as straightforward as one might think due to the new nature of its concept. However, as time progresses, they will likely become more accessible. A quick search can always provide the necessary information.

You must note that not all Bitcoin ATMs provide selling and buying options for Bitcoins. However, a few offer this bi-directional functionality. These machines allow users the flexibility to buy and sell Bitcoin transactions.

You simply need to locate a Bitcoin ATM near you, choose the amount of Bitcoin you want to sell, run a quick verification procedure, and then send the Bitcoin. Once you’ve sent the Bitcoin from your wallet, you can go instantly withdraw your fiat cash.

Another exciting thing about this way of selling is that you can send Bitcoin directly from your crypto casino account to the Bitcoin ATM. This completely depends on whether your Bitcoin casino supports the same cryptocurrencies as the ATM.

Pros

- No required bank amount

- ATMs available across the globe

Cons

- Unlike traditional exchanges, Bitcoin ATMs require high fees

- Unavailable in rural areas

-

Gift Cards

Although not exactly cash, converting cryptocurrency into versatile gift cards offers a near-equivalent option. As you may know, you can use various platforms to acquire gift cards, allowing you to sell crypto holdings for popular options, including:

- Prepaid Mastercards

- Best Buy gift cards.

Gift cards are also secure and convenient since they’re tied to personal accounts users have on the issuing platform. It is important to note however that the use of gift cards might be limited to the issuing company. For example, only being able to use Best Buy gift cards at Best Buy.

Pros:

- Gift cards are received instantly

- Wide variety to choose from, e.g Best Buy, Amazon, etc.

- Secure to your personal account

Cons:

- Use is limited to only the Gift Card issuers.

How To Sell Bitcoin: Quick Summary

So, what have we learned?

If you’re looking to sell the Bitcoin you earned from airdrops, crypto casino gambling, and so on, you can do so through any of the following means:

- Exchanges

- Direct Trades

- P2P Trading

- Bitcoin ATMs

- Gift Cards

What to Consider When Cashing Out

Although converting Bitcoin into cash might seem straightforward, there are a few crucial aspects to ponder before cashing out your crypto wallet.

-

Taxes

As you may know, converting Bitcoin into fiat currencies often triggers a taxable event, regardless of which payment method you use for the transaction. To ensure compliance with taxation regulations specific to your location, seeking advice from a tax professional is advisable.

-

Transaction Fees

Bear in mind that transaction fees are associated with converting your cryptocurrency into cash. The size of your transaction often plays a role in determining the payment method you opt for.

Balancing this consideration ensures you select the method that aligns best with your specific needs and the nature of your transaction.

-

Speed

Each approach has its unique investment of time and effort. For instance, conducting transactions on a centralized exchange typically demands less time and effort compared to P2P exchanges or locating a Bitcoin ATM.

The choice ultimately hinges on finding the right balance between convenience and the specific goals of your transaction.

For example, for some gambling enthusiasts, the choice may be Bitcoin ATMs – as they are a direct method that could require just your casino platform and the Bitcoin ATM. For other gamers, Direct Trades may be preferred for the added security, even though it can be time-consuming.

-

Market Health and Long-Term Objectives

In the cryptocurrency world, some buyers have a long-term perspective, aiming to follow the market trends. In contrast, others want to convert their holdings into cash upon making a profit, and knowing which category fits your choice is important. This decision depends on your objectives, market conditions, and financial landscape.

The Best Way to Sell Bitcoin for Crypto Gambling

We here at BitcoinCasinos personally recommend exchanges as the best way to sell your Bitcoin from crypto gambling. There are many methods you could use to sell your Bitcoin winnings you have earned from crypto games or sports betting. But for us, exchanges definitely stand out as the best.

This is because exchanges tick all the boxes when it comes to speed, convenience, and compatibility with gambling platforms.

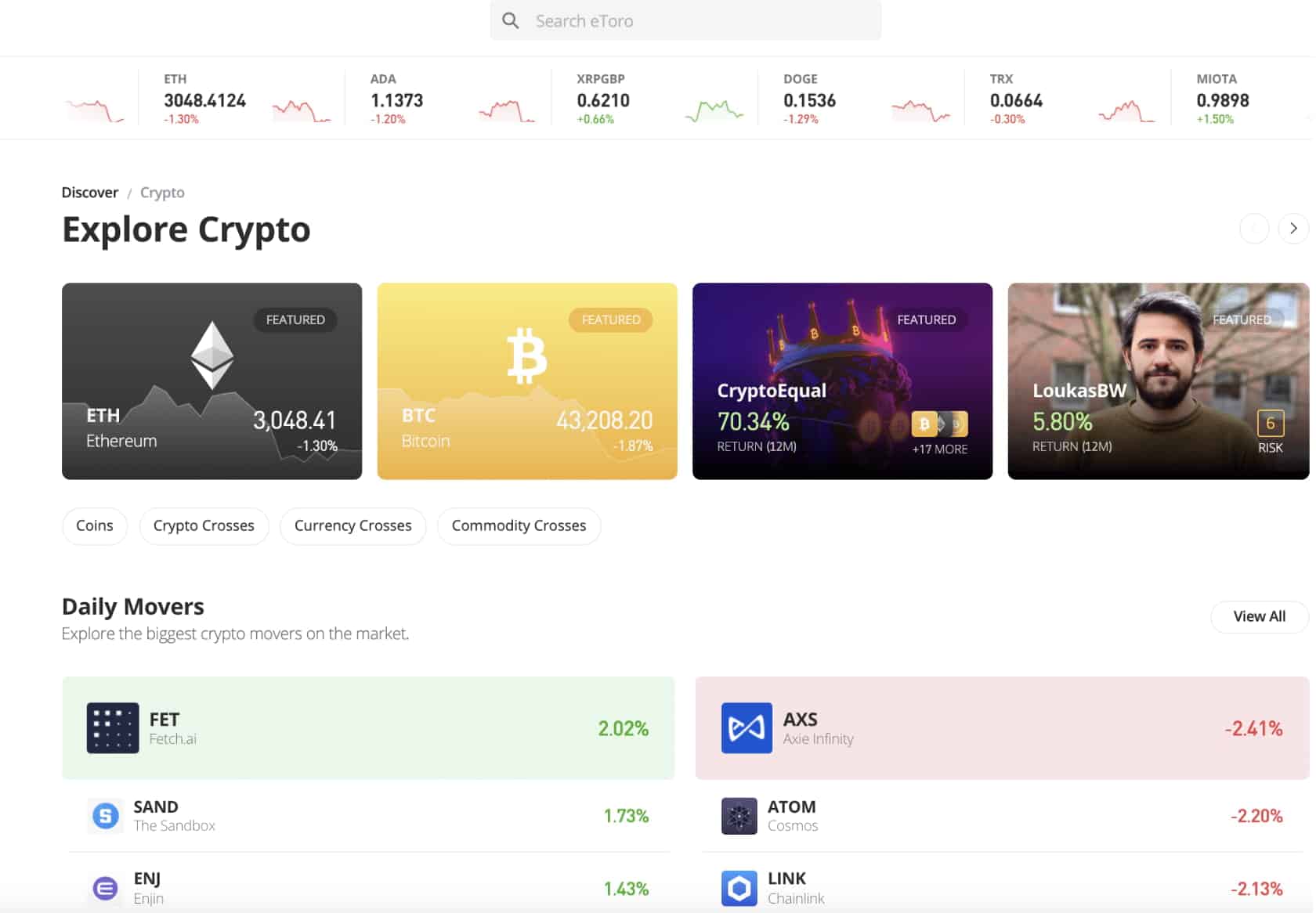

In terms of the best exchange available, we believe eToro to be the most comprehensive choice for crypto gamers. eToro stands out as one of the best exchanges because of its dedicated wallet. This allows gamblers to withdraw their crypto casino winnings instantly, before selling on eToro’s exchange platform.

How To Sell Bitcoin: Our Final Thoughts

The cryptocurrency world is ever-growing, and selling Bitcoin is a significant step that needs careful consideration and informed decision-making. From exchanges to P2P trading and Bitcoin ATMs, each avenue has its advantages and trade-offs.

While these methods differ in terms of fees and convenience, the ultimate goal is the same: to convert your Bitcoin earnings and your other digital assets into tangible gains. However, this decision depends on personal financial goals and market conditions.

Whether you are a long-term crypto enthusiast or looking to capitalize on immediate profits from crypto sports betting, slot games, and more – aligning your choice with your objectives is important. Use the steps we’ve provided to your advantage and realize your aspirations in the ever-evolving crypto world.

Frequently Asked Questions

Does Selling Bitcoin Pose Any Risks?

For beginners, selling Bitcoin might seem intricate, yet there are many resources and services available to help streamline the procedure. Cryptocurrency exchanges and marketplaces often provide user-friendly interfaces and comprehensive guides to help you sell Bitcoin quickly and easily.

Can I Transfer My Bitcoins to My Bank Account?

Absolutely! To transfer Bitcoins to your bank account, you must sell your Bitcoin for fiat currency on a cryptocurrency exchange platform or marketplace. Then, you can move the acquired fiat currency to your bank account using a wire transfer or other payment options.

What Is the Duration to Sell 1 Bitcoin?

The time required to sell 1 Bitcoin depends on the specific selling method employed, the prevailing Bitcoin price during the sale, and the processing speed of the chosen exchange. Generally, selling Bitcoin spans from just a few minutes to extending over several days.

Tom Middleton is our crypto gambling expert with more than a decade of experience in the industry and a Master’s Degree in Journalism. He’s spent his career providing the public with thoroughly researched crypto gambling guides and reviews via several major publications as Business 2 Community and The Sun. Tom started working on BitcoinCasinos.com on 2022 and has happily dedicated his life to helping players make the most from their playtime, as an avid player himself, this is where his passion lies.

Recent Posts

-

Cryptocurrency Miners Stockpile Near-Record Amount Of Bitcoin Ahead Of Friday’s Supply Cut

-

Snoop Dogg And Roobet Join Forces To Create ‘Snoop’s High Rollers’ Slot Game

-

Adin Ross ‘Announces’ Surprise Retirement From Streaming At Age 23

-

Ethereum Revealed As The Leading Crypto For Blockchain Hacks In 2024

-

Softswiss Acquires Huge Stake In Europe’s Popular Social Casino SpinArena

1026/02/231006/09/239.705/01/239.704/03/249.405/01/239.205/01/239.107/03/24908/09/23904/03/248.924/01/238.510/10/238.427/03/248.408/09/238.227/02/24