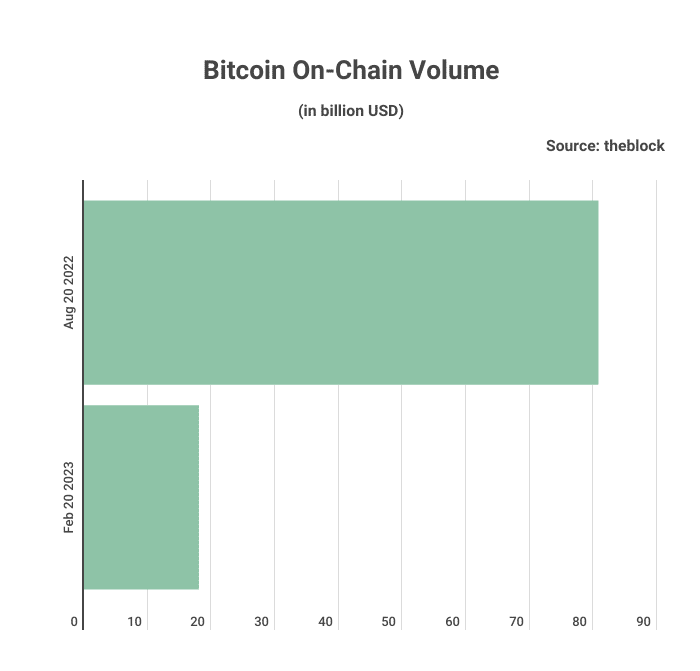

Bitcoin has been one of the most talked-about topics in the world of finance and technology for quite some time now. BTC has been around for over a decade and has seen its fair share of ups and downs. According to an analysis by BitcoinCasinos.com, the average daily bitcoin transaction amount has decreased by 78% over the last 6 months.

Speaking on the data, BitcoinCasino betting expert Edith Reads said. “The decrease in the daily transaction amount is a clear sign that people are not utilizing Bitcoin as much as they used to. The overall market sentiment could be partly attributed to this, as people are becoming more cautious with their investments”.

Understanding On-Chain Volume and Reason for the Plunge

On-chain volume refers to the total amount of crypto moved on a blockchain network. It is a crucial metric that indicates network activity and user engagement. It includes the number of transactions and the amount of Bitcoin transferred.

There could be several reasons behind the decline in Bitcoin’s on-chain volume—the increased adoption of layer-two scaling solutions allowing faster and cheaper transactions off the main Bitcoin blockchain.

Besides, the crackdown on crypto mining and trading in China also affected Bitcoin’s on-chain volume. In June 2022, the Chinese government banned all crypto-mining activities.

Moreover, the overall market sentiment toward Bitcoin has also been bearish in the past few months. Several factors, including regulatory scrutiny and environmental concerns, have led to declining investor confidence in Bitcoin. This could have decreased demand for Bitcoin, leading to a drop in on-chain volume.

Institutional investors and growth companies reduced their exposure to Bitcoin. Its correlation with the broader market is decreasing. As a result, the on-chain volume gets less.

As inflation rises, Bitcoin’s decoupling from stocks could position it as an investment hedge. This could entice institutional investors to re-enter the Bitcoin market. Some analysts suggest that Bitcoin’s potential as an equities hedge could be a game-changer. This could raise the on-chain volume of the Bitcoin Blockchain.

Impact of Bitcoin’s On-Chain Volume Plunge on the Crypto Market

The decline in Bitcoin’s on-chain volume could have several implications for the broader crypto market. It could decrease the price of Bitcoin and other cryptocurrencies as it indicates lower demand and activity.

Also, it could affect crypto exchange revenue that relies on trading fees generated by on-chain transactions. It could also hinder the adoption and mainstream acceptance of Bitcoin and other cryptos as viable payment methods.

However, on-chain volume is one of several metrics analysts use to evaluate a crypto’s health and growth potential. Other metrics, such as market cap, liquidity, and adoption, are crucial in determining a crypto’s value and prospects.