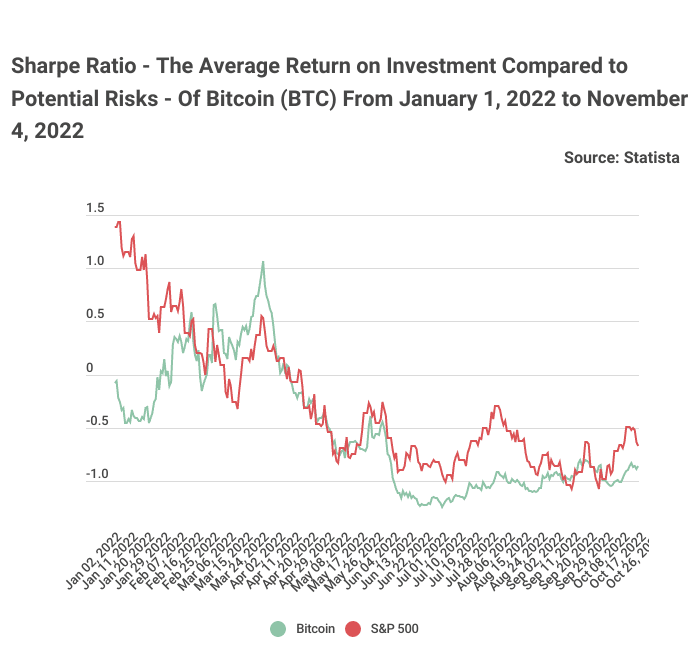

Bitcoin’s Sharpe Ratio has suffered a drastic decline since the start of last year. Data by BitcoinCasinos.com shows that the digital asset’s ratio was -0.86 in November 2022, down from 6.21 in January 2021.

According to Edith Reads, an investment lead at the site, the current ratio doesn’t give any helpful information about BTC’s returns. “The Sharpe Ratio is a measure of risk-adjusted returns, and the higher it is, the better the asset’s risk-adjusted performance. A negative ratio could either mean the risk-free rate of return is higher than the asset’s, or we can expect a negative return on the asset. Either way, there’s not much information to go by.”

Ms. Reads further added that although the S&P 500’s ratio had declined, it is currently higher than BTC’s at -0.67. In January 2021, S&P 500’s Sharpe was 2, considered very good.

What Does The Sharpe Ratio Mean?

The Sharpe Ratio was invented in 1966 by William Sharpe and has become a popular tool among finance professionals. The ratio simplifies the risk vs. reward relationship and shows whether an asset is making profits through leverage.

A higher Sharpe shows better performance on a risk-adjusted basis. Zero indicates the asset is risk-free, while a negative value doesn’t convey any useful meaning about the assets’ rewards relative to risk.

The decline in BTC’s Sharpe can be attributed to the highly volatile markets over the past few months. Crypto winter has hit hard, with companies and projects failing daily. The markets have become highly volatile, which could explain the negative Sharpe Ratio.

We could expect a correction, as the markets seem to be recovering over the past few weeks. BTC’s price has been rallying, and the asset is currently trading at $22.9k, which is $1000 up from November’s $21K. We can, therefore, anticipate a higher Sharpe as analysts speculate whether the rally is the beginning of the much-awaited crypto bull run.

Sharpe Ratio Doesn’t Apply to Bitcoin

In 2020, former options trader and risk analyst Nassim Taleb commented that the ratio doesn’t work for BTC. The tweet responded to a publication by Plan B, highlighting that Bitcoin was the only asset whose Sharpe was higher than 1.

Although he didn’t explain further, there’s some truth to what he said. For starters, the ratio works on the assumption that returns are normally distributed, which isn’t the case. Certain crucial events lie outside the normal distribution and even more so for BTC. Mass adoption, exchange hacking, FOMO, and bitcoin regulations are some of the most probable events leading to off-the-chart movements.

The Sharpe Ratio doesn’t account for any of these events, making it almost impossible to give meaning to the ratio.