The world of cryptocurrency exchanges is becoming increasingly crowded with each passing day. This has resulted in an ever-increasing number of options for investors, traders, and developers alike. However, when it comes to Ethereum (ETH) exchange holdings there can be no doubt that the two giants of the industry – Coinbase and Binance – command the lion’s share of the market. According to BitcoinCasino.com, 55% of the 24.9 million ETH exchange holdings are held on these two exchanges.

Edith Reads, the Financial analyst of BitcoinCasino, spoke on the data. “Given the sheer size and liquidity offered by the two services, it is no surprise that they represent such a large portion of the overall Ethereum market. Both exchanges have created comprehensive trading platforms designed with both novice and professional traders in mind.”

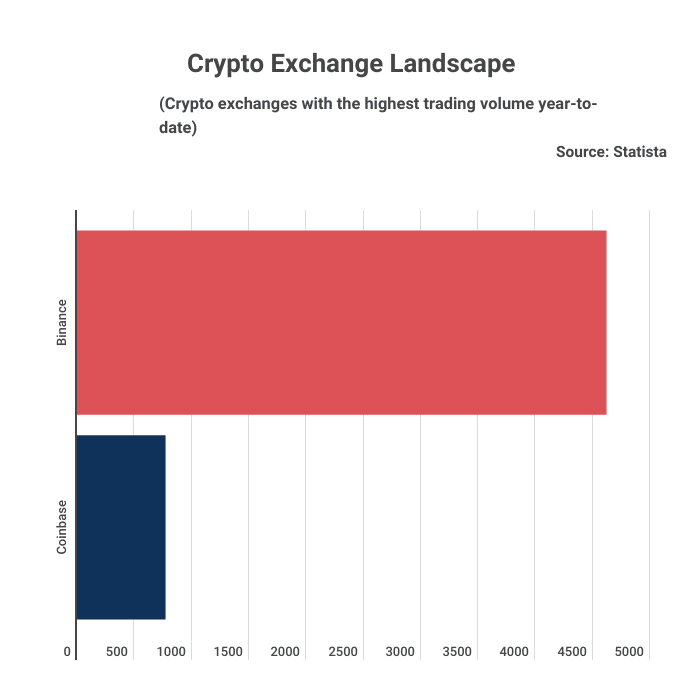

Dominance of Coinbase and Binance in the ETH Market

The two most dominant players in the ETH market in the recent past year have been Coinbase and Binance. Together, they control over 55% of the market. This dominance is due to their aggressive marketing campaigns and massive user bases.

Coinbase, the largest ETH exchange, has attracted new users with its user-friendly interface and popular mobile app. Binance, on the other hand, has been able to grow its user base by offering a wider variety of coins and tokens.

The dominance of Coinbase and Binance has had a major impact on the ETH market. For one, it has made it difficult for new exchanges to enter the market. Secondly, it has resulted in higher ETH prices, as the two exchanges have been able to control the price of ETH.

This will likely continue as the two exchanges snowball. This is terrible news for ETH users, as it will likely result in higher ETH prices.

With low fees and fast transactions, Binance has attracted many traders and investors. Coinbase and Binance have invested in security measures to ensure the safety of their users’ assets.

They use advanced security technologies such as multi-signature wallets, two-factor authentication, and cold storage to protect users’ digital assets. They also have robust risk management systems to track and detect suspicious activity.

Top ETH Exchanges

As Ethereum continues to grow in popularity, more people are looking to invest in ETH. There are many ETH exchanges, each with advantages and disadvantages. Here are some of the top ETH exchanges and what they offer.

Coinbase

Coinbase is one of the most popular cryptocurrency exchanges and allows you to buy ETH with USD. Coinbase offers many other features, such as a wallet, storage, and a payment processor.

Binance

Binance is a Chinese-based exchange that allows you to buy ETH with BTC. Binance offers many other features, such as a wallet, storage, and a payment processor. Binance is a good option for those looking for a simple way to buy ETH.

Gemini

Gemini is a US-based exchange that allows you to buy ETH in USD. It is one of the most trusted exchanges. Gemini is a good option for those looking for a reliable and regulated exchange. However, Gemini offers fewer features than other exchanges.