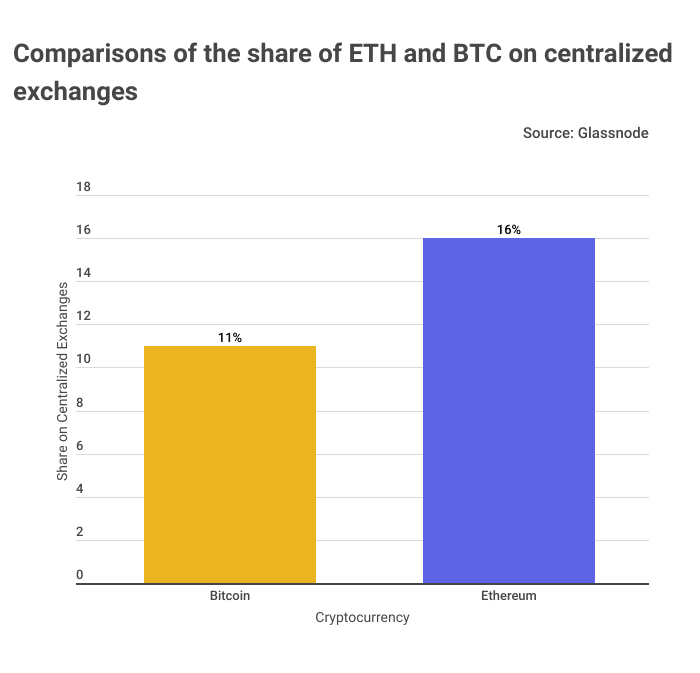

Centralized Exchanges (CEXs) hold far more Ethereum (ETH) than Bitcoin (BTC). That’s per a BitcoinCasinos.com data presentation. The site reports that 16% of ETH is still on CEXs compared to 11% of BTC. To put it into perspective, ETH holdings across exchanges stand at roughly 19.3M, while BTC’s is nearly 2.27M.

The most likely reason CEXs hold more ETH than BTC is the project itself. Ethereum has become a hub for decentralized finance (DeFi) and other applications since its launch in 2015. This means that users who want to participate in these services need to acquire ETH from different CEXs.

On the other hand, Bitcoin’s use case has long been an investable asset. So users who wish to buy it tend to store it in hardware wallets for safekeeping.

BitcoinCasinos investment expert Edith Reads also suggests ETH investors are less worried about fake assets or rehypothecation on CEXs than BTC holders. She said: “Ethereum investors are seemingly more confident in the measures that CEXs take to protect their funds and assets. That signals faith among them that is increasingly seen as lacking among the more wary Bitcoin holders.”

CEXs Recorded Reduced Transaction Volumes in 2022

2022 was a turbulent year for centralized exchanges. A prevailing bear market led to ETH dropping as low as $995 on 19th June 2022 and BTC clustering around the mid-to-low-$17K at the tail-end of the year. With these and other crypto assets’ values taking a hit, transaction volumes on CEXs subsequently reduced by 46%, according to a CryptoCompare report.

This created the perfect storm of market stagnation. On top of that, industry confidence in centralized exchanges shook with several major crypto firms such as 3AC, TerraLuna, and FTX declaring bankruptcy. These events created panic among investors as there were doubts regarding the security of their funds on these exchanges.

Consequently, Decentralized Exchanges (DEXs) have been gaining popularity as many investors look for more secure ways to trade. DEXs are gaining traction in the crypto market for their ability to give users more control of their funds and privacy than CEXs.

CEXs Outperformed DEXs

Despite the shift, the total trading volume for CEXs outdid the DEXs throughout the year. That indicates that while people may want the advantages of decentralization, they also value liquidity and other benefits of trading on a CEX.

Moreover, CryptoCompare’s report shows that Binance continues to dominate the CEX market. It states tha the exchange grew its market share from 48.7% in Q1 2022 to 66.7% in Q4 of the year, cementing its stranglehold over the industry’s eleven most significant exchanges.

The report attributes Binance’s success to consolidating its market share amidst increased competition for declining volumes. It also notes that increased platform transparency and security will be critical factors shaping the development of the CEX industry from 2023 and beyond.