Exchange-traded funds(ETFs) have revolutionized the investment landscape, allowing all types of investors to access various benefits. These include diversification, simplicity, low expenses, transparency, customization options, and global market exposure. Typically, ETFs are exchanged like regular stocks while tracking a specific index, sector, or commodity. They consist of multiple assets like bonds and equities, usually at lower costs than mutual funds, making them an easy go-to option for traders and investors.

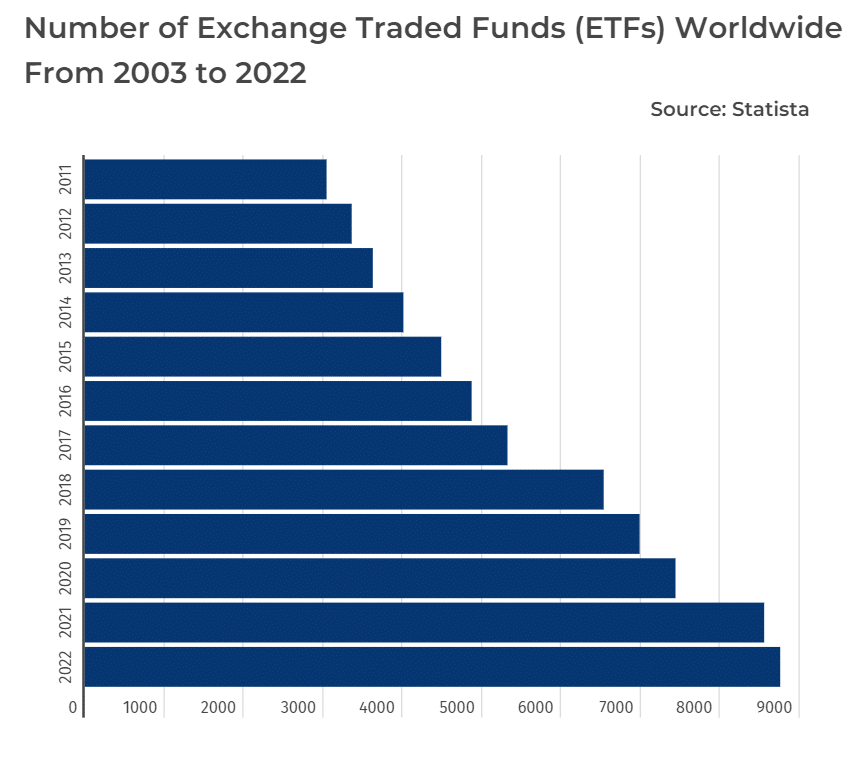

According to BitcoinCasinos.com, ETFs have increased substantially by about 161% in just ten years. In 2022, there were 8,754 ETFs globally, compared to 276 in 2003.

The site’s financial analyst, Edith Reads, comments, “ETFs serve as the perfect foundation for investors looking to diversify their portfolio and complement other investments of their own. The rise in ETFs for the last ten years is a testament of how much potential these investments hold. Ideally, they guarantee substantial returns and work to give investors incredible versatility. “

The ETFs Count

The number of ETFs in 2022 all amount to assets worth $10 trillion. In the US alone, the assets amount to nearly $ 6.4 trillion, a tremendous increase from $ 151 billion in 2003. From 123 ETFs in the US in 2003, the ETF industry has dramatically expanded, and the US is home to over 2700 ETFs.

Currently, ETFs with the same value as Bitcoin amount to about $4.16 billion. Most of those ETFs are in Canada, where the largest ETF, Purpose Bitcoin ETF, has nearly $820 million in assets.

Additionally, ETFs represent about 12.7% of equity assets in the US, 8.5% in Europe, and 4.4% in Asia-Pacific. In Q3 23, ETF daily trading equities in Europe accounted for nearly 9.6% of the average daily total European equities of about $89.5 billion during the quarter—moreover, ETFs accumulated over $ 20 billion for Asia Pacific investors in the same quarter.

Generally, State Street’s SPDR S&P 500 ETF Trust is the highest-valued exchange-traded fund globally, with a market capitalization of over $ 365 billion. However, the top provider of ETFs globally is Blackrock, which had over 2.1 trillion dollars in the US alone at the start of Q3 ’22. Following Blackrock are Vanguard and State Street, which comprise the list of the top 3 providers.

Why have ETFs Become Popular?

ETFs give the best of both worlds; they’re funds that trade like stocks while offering the diversification benefits of mutual funds.

They are less costly and have flexible trading techniques; hence, investors have been drawn to them. Besides, they offer a wide range of assets, providing the best investment platforms.

The incredible rise in ETFs suggests that these pooled investments are here to stay and are an ideal choice for traders and investors. The ETFs are bound to lure in more investments in the upcoming future.