Decentralized Finance, or DeFi, represents a revolutionary shift in the financial landscape by enabling individuals to engage in various financial activities without the need for traditional intermediaries like banks.

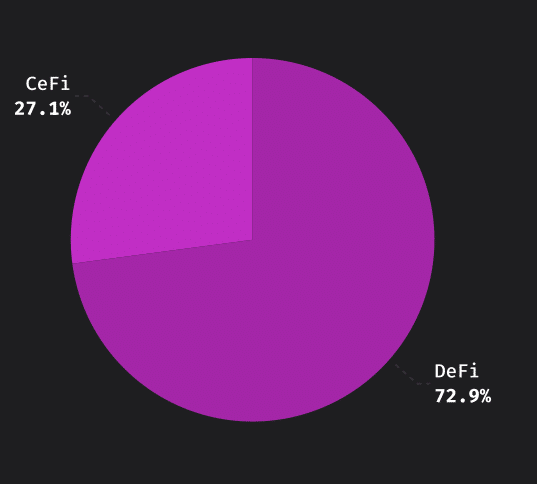

Utilizing blockchain technology and smart contracts, DeFi platforms offer decentralized and often permissionless services such as lending, borrowing, trading, and yield farming. While DeFi holds great promise, it is not without its challenges, one of the most prominent being the vulnerability to exploits. According to BitcoinCasinos.com. DeFi was the favorite target of hackers and cybercriminals, accounting for 73% of successful crypto exploits.

Edith Reads, a specialist from BitcoinCasinos, had this to say. “While DeFi platforms promise financial inclusivity and freedom from traditional banking systems, an alarming trend has surfaced, marked by a surge in scams, rug pulls, and fraudulent schemes. As the DeFi space grows, so do the opportunities for malicious actors to exploit vulnerabilities in decentralized protocols, leading to substantial financial losses for unsuspecting investors. This alarming trend underscores the importance of robust regulatory frameworks, thorough due diligence, and investor education in the crypto industry.”

DeFi Alarming Trend in the Crypto World

The data shows a disturbing pattern in the world of cryptocurrency security. Over the last three months, 73% of all successful exploits targeted DeFi platforms, while only 27% targeted CeFi. Throughout 71 incidents in Q3 2023, DeFi lost $499,810,444 in total. In contrast, DeFi losses came to $423,423,783 in Q3 2022, thus reflecting a rise of 18.5%. The significant jump underscores the need to tighten security around the DeFi ecosystem.

Solutions to DeFi Exploits

Addressing DeFi exploits requires a multifaceted approach involving developers, regulators, and the community to mitigate risks and enhance the security of decentralized finance platforms. First, thorough code audits by reputable cybersecurity firms can help identify smart contract and protocol vulnerabilities. Regular audits and continuous monitoring are essential to stay ahead of potential exploits. Developers should also follow best practices in secure coding, including using formal verification methods and conducting extensive testing to identify and fix vulnerabilities before deployment.

Additionally, implementing decentralized governance models where decisions are made collectively by the community can enhance transparency and reduce the risk of central points of failure.

Lastly, DeFi platforms can collaborate with insurance providers to offer coverage against hacks and exploits. This can mitigate losses for users and provide an additional layer of security.

By combining these efforts, the crypto community can work towards a more secure DeFi ecosystem, fostering innovation while minimizing the risks associated with exploits and scams.