The financial technology sector has been a hotbed of innovation, with blockchain technology leading the charge in recent years.

The third quarter of the year has witnessed a notable surge in funding within the decentralized finance (DeFi) sector, solidifying its position as a frontrunner in the ever-evolving world of cryptos.

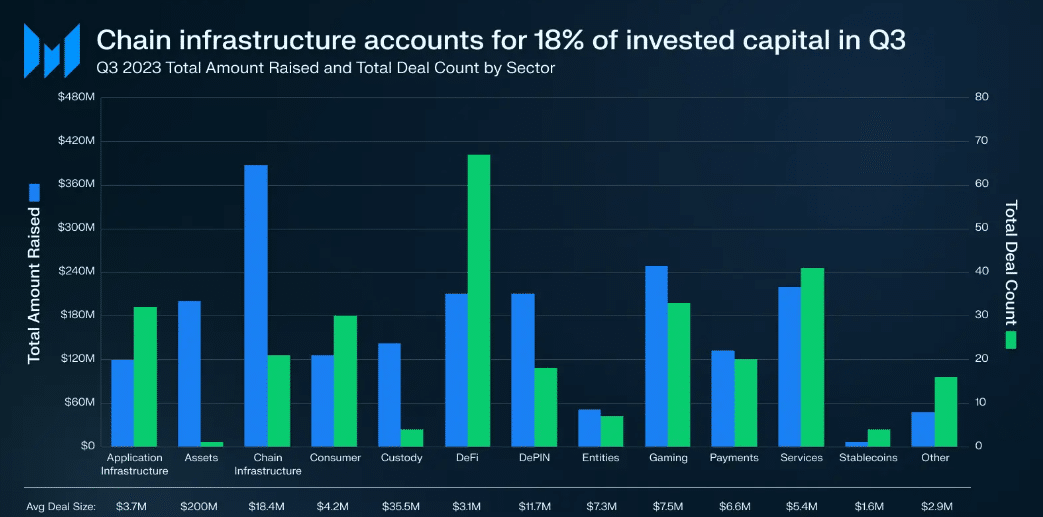

According to BitcoinCasinos.com, DeFi projects have outshone traditional funding avenues in this period, securing a remarkable 67 deals and emerging as a dominant force in the financial technology landscape.

BitcoinCasinos’ crypto expert Edith Reads commented on the analysis,” A myriad of innovative projects within the sector has catalyzed the surge in DeFi funding. These include decentralized lending platforms, liquidity pools, yield farming protocols, and more. Each project offers unique opportunities for investors, ranging from those seeking stable returns to those willing to take calculated risks for potentially higher rewards.”

The DeFi Revolution

Decentralized Finance represents a paradigm shift in the way financial services are delivered. DeFi platforms operate on blockchain networks, unlike traditional banking and financial institutions, enabling peer-to-peer transactions without intermediaries. This decentralized approach increases the efficiency of financial services and enhances accessibility, making banking services available to anyone with an Internet connection.

Q3 Funding Frenzy

In the third quarter, DeFi stood out as the sector with the most funded projects. Notably, investments in this sector were concentrated, with almost 40% of the total invested capital spread across 33 deals in the exchange category.

In aggregate, DeFi projects amassed a substantial sum of $210M, with an average deal size of $3M.

During this period, Binance Labs actively engaged in the DeFi sector, participating in seven deals. Their strategic investments included $10M each in Helio Protocol, a liquid staking platform on BNB Chain, and Radiant Capital, a money market built on LayerZero.

The most significant DeFi deal of the quarter involved a Series A funding round for Brine, an order-book DEX constructed on Starkware, amounting to $16.5M.

Additionally, based on the deal count, three of the top four investors in DeFi were closely affiliated with the ecosystem. Binance Labs, the Base Ecosystem Fund, and Polygon collectively contributed to 16 deals during this period, underscoring the sector’s robust investor support.

Innovative DeFi Projects

One of the reasons behind the surge in funding for DeFi projects is the continuous innovation within the sector. DeFi projects offer various previously exclusive services to traditional financial institutions, from decentralized lending and borrowing platforms to yield farming protocols and liquidity pools. This innovation attracts investors and encourages more users to participate in the DeFi ecosystem.

Risks and Rewards

While the DeFi space holds immense promise, it has challenges. The decentralized nature of these platforms can sometimes lead to vulnerabilities, making them susceptible to hacks and exploits. However, the industry has been quick to respond to such challenges, with developers and security experts collaborating to enhance the security measures of DeFi protocols.

Investors, too, are becoming increasingly aware of the risks associated with the DeFi space. As a result, they are conducting thorough due diligence before investing their capital, ensuring that they choose projects with solid fundamentals and robust security features. This cautious approach is essential for the long-term sustainability of the DeFi ecosystem.