Bitcoin addresses serve as the fundamental building blocks of the network. They allow users to send and receive transactions securely. Each address represents a unique destination for Bitcoin transactions, functioning like an email address. According to BitcoinCasinos.com, the Bitcoin network has recently witnessed a significant drop. Over the course of just two weeks, the number of new addresses created on the Bitcoin network has plummeted by a staggering 37%.

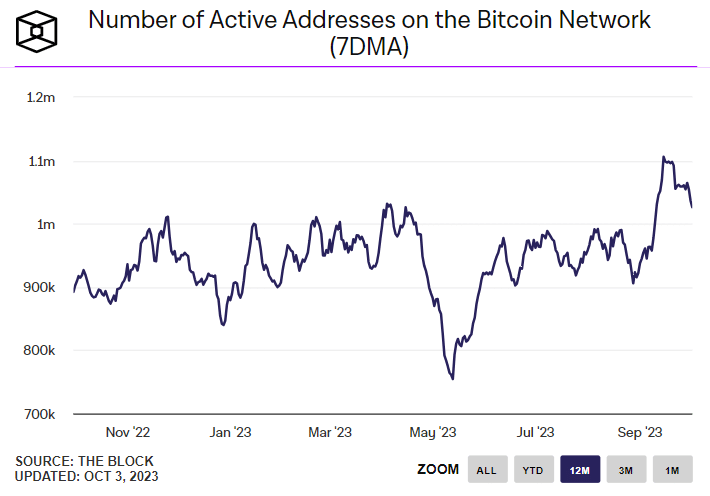

The site’s financial analyst, Edith Reads, commented on the data, saying, “The decline in the creation of new addresses raises several questions about the health and growth of the Bitcoin ecosystem. The active addresses are around cyclical lows of 411,000. These addresses are a key metric indicating the level of participation and engagement within the Bitcoin ecosystem.”

Factors Influencing This Shift

The decrease in new addresses could be attributed to various factors. One of the primary reasons might be the recent market volatility that has gripped the cryptocurrency space.

New Investors may be hesitating to enter the market amid rapid price fluctuations. Uncertainty regarding regulatory developments in various states could also be dissuading potential investors from joining the BTC network.

Additionally, the decline could indicate a broader trend in the crypto landscape. Alternative cryptos, often referred to as altcoins, have been gaining popularity and attention. As more blockchain projects emerge, investors have more options to explore. This diversification might be diverting some interest away from Bitcoin, leading to a slowdown in the formation of new addresses.

Furthermore, the market’s maturity might also play a role in this decline. As Bitcoin continues to establish itself as a reliable store of value, the frenzied excitement that once surrounded its early days might be subsiding.

People once eager to jump on the BTC bandwagon might have already done so, resulting in a natural slowdown in new address creation.

Despite these challenges, it’s essential to approach this situation with a balanced perspective. The cryptocurrency market is renowned for its volatility; trends can change rapidly. With its robust infrastructure and widespread adoption, Bitcoin has weathered numerous storms since its inception.

Moreover, the crypto community has consistently demonstrated resilience and adaptability. Developers, investors, and enthusiasts continually work on innovations and solutions to address the challenges faced by the industry. Regulatory clarity, technological advancements, and increased awareness can reignite the interest in Bitcoin, leading to a resurgence in the number of addresses.