Venture capital funds are constantly searching for innovative and vibrant companies that can accumulate great returns and diversify their current market status.

Crypto companies have checked the boxes for most of these VCs for some time now. Many have flocked to the market looking to invest in crypto with significant gains in mind.

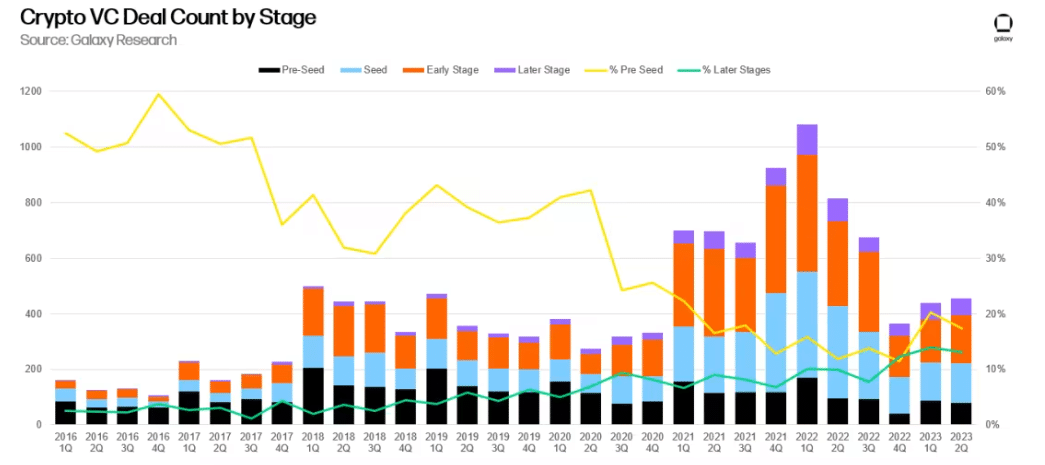

However, most have been keen to invest in high-growth startups still in their seed stage. According to BitcoinCasinos.com’s analysis, early-stage VC deals account for 73% of the total.

The site’s financial analyst, Edith Reads, comments, “The crypto VC market is still alive, and while the deal count is promising, it is important to note that the value of the investment placed is dwindling. As of Q2’23 the total crypto investments amounted to $2.3 billion, the lowest since 2020 signaling the need for the crypto industry to look for more potential investors.”

The Overview of Crypto VC Investing

Despite the overall crypto investments plummeting, the Crypto VC market is still thriving, with the number of deals rising.

As of Q2’23, the deal count stands at 456 deals, a slight rise from quarter one’s 439. The slight increase in Serie A deals from 174 to 154 majorly contributed to the rise in deal count.

Of all the deals, early-stage deals from Pre Seed, Seed, and Series A accounted for nearly 75% and later-stage at 27%. More statistics reveal that the US-based companies contributed most of those deals, around 43%, followed by Singapore and the United Kingdom with 7.5% each and South Korea at 3.1% in Q2’23.

However, the total capital invested by VCs is seeing a significant decline in QoQ. The overall valuations are declining, with the median pre-money valuation at $17.93 million, the lowest amount since Q1’21.

Notably, Trading, Exchange, Investing, and Lending startups are in the lead for the most venture capital in Q2 ’23, followed by Web 3 and NFTs at $442 million.

Why are Early-stage VC Deals More Lucrative to Crypto Investors?

Investors are drawn to them because most seed companies in their early stages have low valuations. They can easily buy shares and put in small investments at a time at lower prices than later-stage deals. Besides, early-stage companies have more room for growth and change in the overall structure and system.

While these seed-stage ventures are full of risks, fundamentally, they’re key to promoting future businesses and shaping the crypto industry.