With interest in Blockchain technology and the crypto space growing exponentially, many public companies are racing to acquire and hold as many digital assets as possible. Microstrategy is one of those few companies that include crypto in their systems. Over the years, the company has accumulated substantial Bitcoin assets, cementing its position as the leading institutional holder.

According to BitcoinCasinos.com, Microstrategy has accumulated up to 152,800 BTC, a 612.2% increase since its first Bitcoin acquisition in 2020.

The site’s financial analyst, Edith Reads, comments, “The step Microstrategy took in acquiring Bitcoin has proved revolutionary for the company. Its efforts to keep Bitcoin reserves have attracted significant traction among investors and other public companies. Now, its two primary goals are to hold Bitcoin and develop its analytics software to promote business intelligence on its platform. The massive increase in digital assets only serves as a testament to the company’s milestones in acquiring Bitcoin.

The Overview of Microstrategy Bitcoin investment

Since August 11, 2020, when Microstrategy purchased its first digital assets, around 21,454 BTC, the company made it their goal to keep topping up on their Bitcoin assets. Currently, Bitcoin accounts for 74.3% of their total balance sheet assets and 0.786% of Bitcoin’s supply chain.

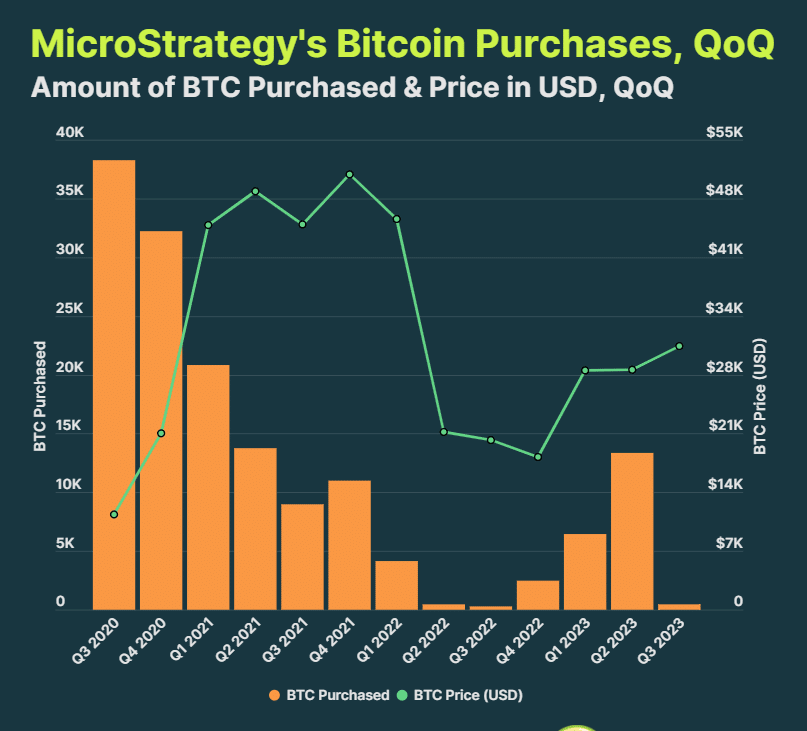

Out of their total Bitcoin holdings, the third and fourth quarters of 2020 marked the most significant Bitcoin purchases in the company’s history, acquiring 38,250 and 32,220 BTC, respectively. These two acquisitions constitute up to 46.12% of the total holdings.

However, since then, Microstrategy has made smaller purchases, making the 12,333 BTC acquired in Q2 ’23 the most significant single investment since Q2’21.

Currently, their Bitcoin assets are worth over $4.6 billion. In comparison, cash and cash equivalents stand at about $65.9 million, a significant decrease from 2019’s cash and cash equivalents of $456.7 million before Bitcoin’s incorporation. The decrease in cash and cash equivalents results from Bitcoin being the company’s primary asset holder.

Why Does MicroStrategy Continue to Make Bitcoin Investments?

Led by CEO Michael Saylor, the Microstrategy community sees Bitcoin assets as long-term investments that will appreciate in the future, increasing the company’s cash flow significantly. The high volatility of Bitcoin serves as a key motivation for this belief as Bitcoin prices keep on changing and project potential returns.

Bitcoin is an excellent store of value, and the company acknowledges that. They prioritize Bitcoin investments, as these digital assets are easily transferred and stored, unlike cash or gold.

Microstrategy’s impressive accumulation of Bitcoin is a testament to how institutions can diversify their financial portfolios and ultimately increase their value. Their achievement is a true reflection of the increasing acceptance and adoption of Bitcoin as a valuable asset. In the foreseeable future, its influence will undoubtedly continue to grow not only in the crypto community but also in the global arena.