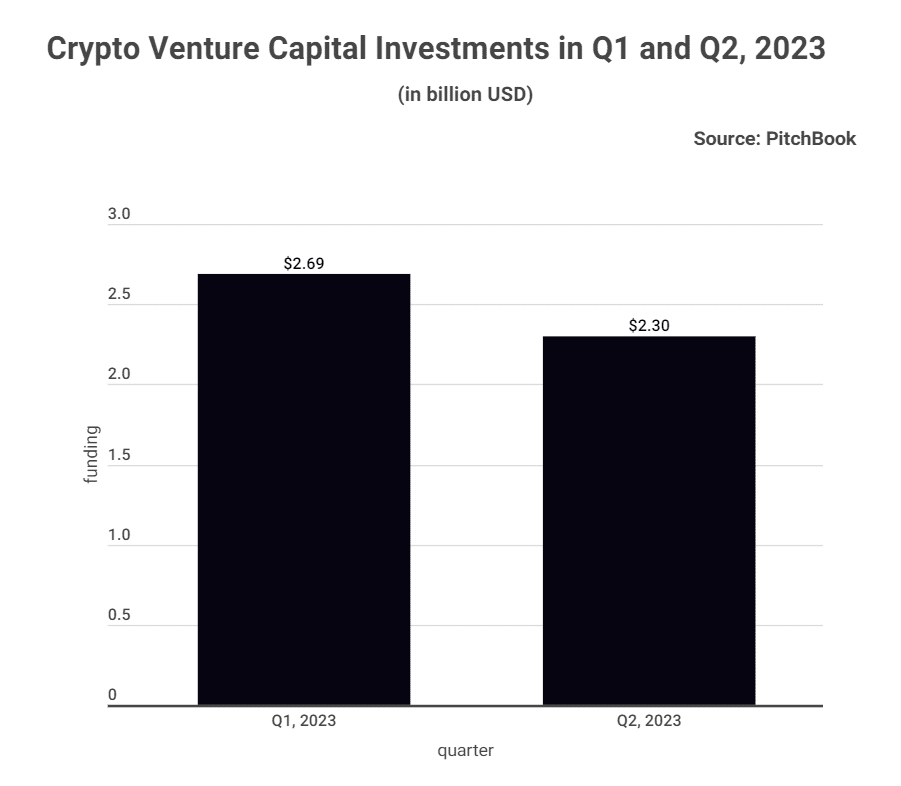

Venture Capital (VC) funding has been a welcome shot in the arm for the crypto sector. Besides infusing the much-needed capital, it opens doors to invaluable strategic guidance, industry connections, and mentorship from seasoned investors. However, this support has been declining, raising concerns about the long-term health of the crypto ecosystem.

A recent BitcoinCasinos.com presentation has revealed the substantial deceleration in VC funding within the crypto space. The firm reports that crypto startups secured $2.3 billion from VC rounds, the least amount raised since Q4 2020. This finding has drawn reactions from the site’s crypto expert Edith Reads.

Edith avered, “The crypto sector is at a pivotal crossroads. While VC funding has historically acted as a catalyst for innovation, the recent downturn signals an urgent need for introspection and adaptation within the industry.”

What’s Behind The Falling Crypto VC Figures?

Several factors underpin this decline in crypto VC funding, notably regulatory concerns. Governments worldwide have assumed diverse positions on cryptocurrencies and blockchain technology, influencing investor sentiment. Regulatory ambiguity has dampened enthusiasm and compelled a reevaluation of investment strategies.

Furthermore, the inherent volatility of major cryptocurrencies has impacted VC funding decisions. In an industry renowned for its tumultuous market dynamics, investors struggle to balance short-term market conditions with the potential long-term value of blockchain technology.

Geopolitical factors have further shaped investor sentiment toward cryptocurrencies and blockchain projects. The COVID-19 pandemic, coupled with economic uncertainty, high inflation, rising interest rates, and the ongoing conflict in Ukraine, has created a more risk-averse environment for investors. In such conditions, they are less inclined to invest in volatile assets like cryptocurrencies.

Implications of Falling Crypto VC

The sustained decline in VC funding carries significant implications for the crypto industry. Primarily, it could impede innovation as startups find it increasingly difficult to secure the necessary resources for developing cutting-edge technologies. This may decelerate the realization of blockchain’s transformative potential across various sectors.

Moreover, reduced VC funding could intensify competition among startups for the limited pool of available resources. As the sector becomes more crowded, only those with robust value propositions, solid teams, and differentiated offerings will likely attract investors.

Edith predicts a recalibration in the crypto investment landscape in the coming quarters. She argues that regulatory developments, efforts to stabilize the market, and the maturation of innovative projects will enable a more balanced environment.

What’s The Future of Crypto VC Funding?

As for the future of crypto VC funding, its trajectory remains uncertain, though it is likely to remain subdued in the near term. However, if the global economy improves and regulatory concerns ease, a resurgence in VC funding for crypto companies may materialize in the coming quarters.

In light of diminishing VC finances, crypto startups may need to explore alternative avenues for funding. Initiatives like Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and decentralized finance (DeFi) platforms could offer alternative means of raising capital and engaging a broader community of investors.

Furthermore, collaborations, strategic partnerships, and grants from blockchain foundations or industry consortia could provide a lifeline to startups needing resources. Projects should emphasize building robust products and services that attract users and investors alike.