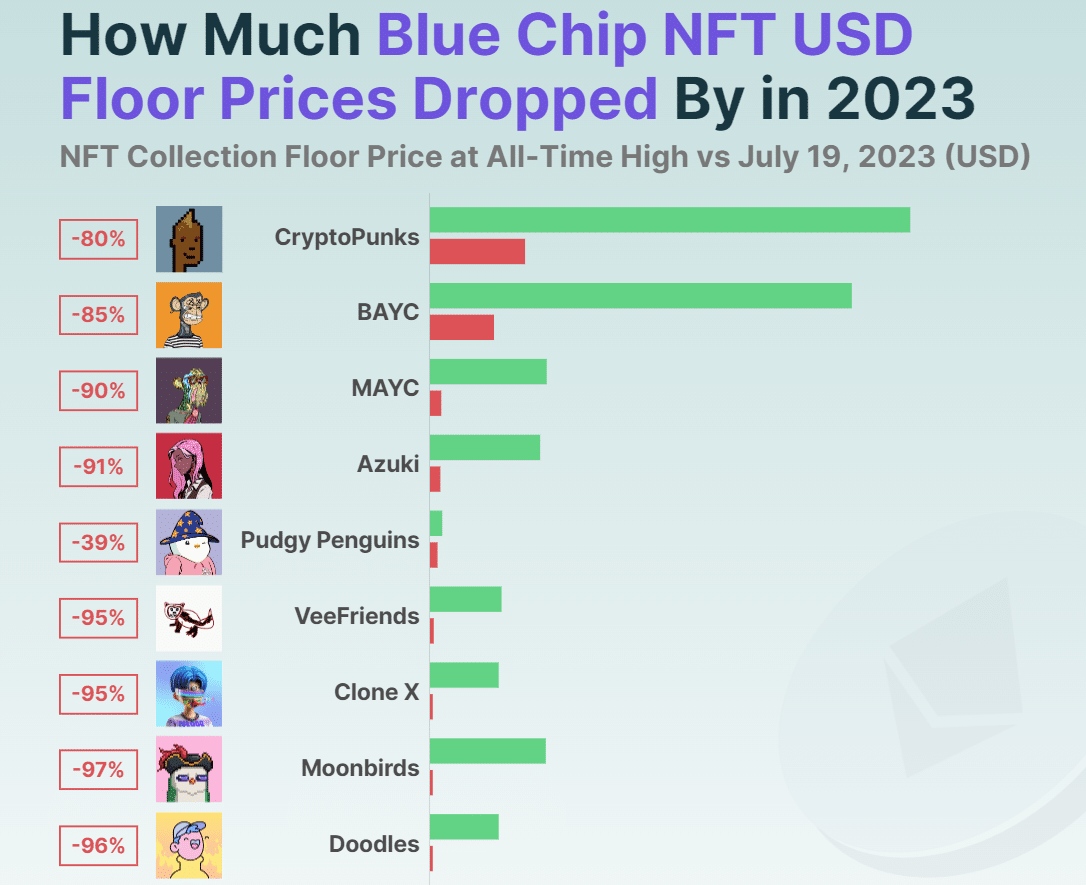

The non-fungible tokens (NFTs) market, once characterized by fervent demand and astronomical valuations, is slumping. According to a BitcoinCasinos.com data presentation, that is particularly true for blue-chip NFTs, the crème de la crème of these digital assets. And no project exemplifies that tapering off more than Moonbirds.

BitcoinCasinos’ report reveals that Moonbird’s floor prices plummeted by an eye-popping 97% from its all-time high (ATH). In the site’s analysis, the NFT’s value has crashed from an ATH of $114,900 to a mere $3,139 on July 19th, 2023. This drop has thrust the NFT market into intense scrutiny, underscoring the fragility of even the most coveted digital assets.

So, Why Are Blue Chip NFT Prices Falling?

The massive plunge in Moonbirds’ and other blue chip NFTs’ floor prices could be attributed to various factors. One notable factor is oversaturation. As more content creators flock to tokenize their creations, an abundance of NFT offerings has inundated the market.

This oversupply has diluted the once-scarce nature of NFTs, driving price corrections across the sector. Edith Reads, BitcoinCasinos’ in-house crypto expert, explained:

“The Moonbirds debacle serves as a stark reminder that even blue-chip NFTs are not immune to the ebbs and flows of market sentiment. The market’s initial hype led to a rush of speculative investments, causing artificial inflation of prices. This correction is indicative of a necessary recalibration, as the market separates truly valuable projects from those that rode the wave of hype.”

Edith added that the NFT market’s lack of regulation enables price manipulation. That has led to concerns about pump-and-dump schemes that can artificially inflate and subsequently crash asset prices. As such, many would-be investors have cooled off their interest in these assets.

What are the Implications of Falling NFT Prices?

As the NFT market navigates through this turbulence, its future hangs in the balance. The implications of falling floor prices reverberate throughout the market and investor sentiment. Many early NFT adopters who had seen substantial gains are experiencing losses, leading to potential unease and hesitancy among creators and investors.

This shift could prompt a rethink of NFT investment strategies, emphasizing long-term value over short-term speculation. Despite the challenges, Edith and other industry insiders remain optimistic about the NFT market’s future.

They contend that while the correction may dampen investments in the space, it is essential in weeding out unsustainable projects and fostering a more mature ecosystem.

Edith suggested that stakeholders are increasingly calling for transparency, standardized auditing practices, and proper due diligence in NFT valuation. Embracing these measures could instill renewed confidence in the market, paving the way for a more resilient and enduring ecosystem.