Decentralized finance (DeFi) is an emerging blockchain technology that eliminates the need for intermediaries like banks while making crypto transactions. This peer-to-peer exchange makes crypto transactions easier by integrating digital wallets and smart contracts into their system.

In recent years, these DeFi platforms have become viable alternatives to centralized platforms, catching the attention of many.

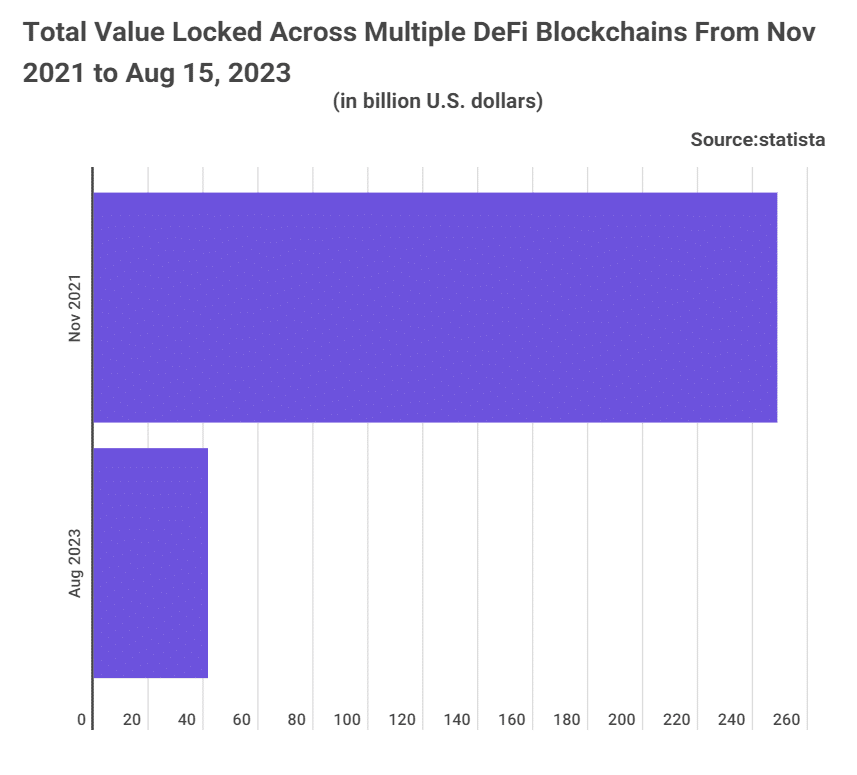

However, these platforms are seeing a significant decline. According to BitcoinCasino.com, the decentralized Finance market size dropped by 83% in April 2023, with the TVL being just under $ 50 billion, about four times less than November’s 2021 TVL.

The site’s financial analyst Edith Reads comments, “Decentralized finance platforms have gained massive popularity over time. The current drop in market value will influence key investors and change some of the users’ perceptions. In the coming days, investors will need to be careful where they put their money, less they lose it all.”

Why Are DeFi Platforms Seeing a Decline?

With DeFi’s popularity on the rise, governments are asking for caution from users. World leaders are setting regulations and suitable guidelines hoping to control their operations and protect users’ assets. However, the increased scrutiny and added regulations have made investors question their participation, leading to a decline in market size.

Over the years, DeFi platforms have been subject to cyber-attacks and exploits.

Phishing and smart contracts vulnerabilities have become common, causing many users to lose their digital assets. Not to mention rug pulls have become an even bigger problem, with many offering lucrative projects and guaranteeing returns only to steal their money. About $45.02 million have been lost to rug pulls. And although DeFi platforms have reinforced their security, investors still need to be convinced that their investments are safe.

Some DeFi platforms’ fall has caused more people to scrutinize their investment choices. Some of those platforms include Terra, whose $40 billion worth practically stooped to zero in a week. Its dramatic collapse stirred huge waves in the DeFi market, with many questioning the practicability and functioning of DeFi platforms. Since then, users have become extra careful in what they put in defi platforms leading to a substantial decline in the DeFi space.

The decline in DeFi market size raises questions about their practicability in today’s market. However, this setback may just be part of the industry’s natural evolution. The DeFi industry must try to win back user confidence to boost their value assets, in the near future.