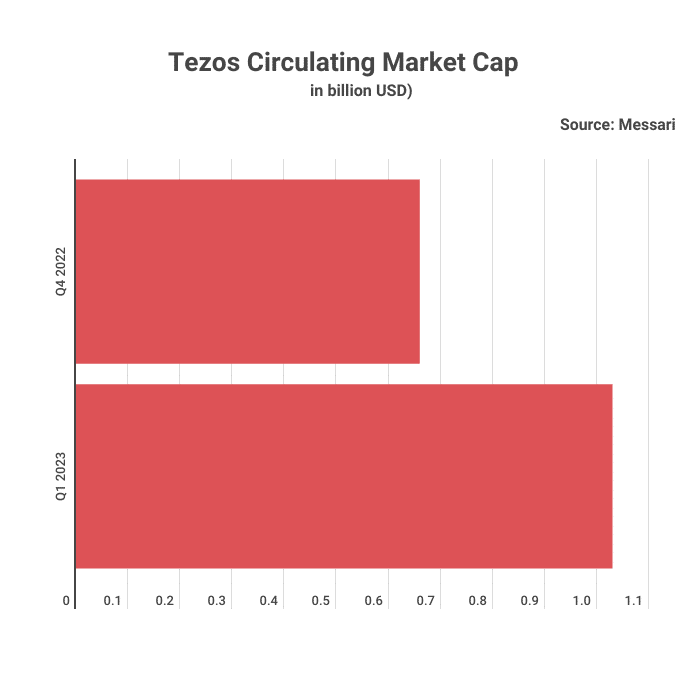

Tezos, a decentralized blockchain platform that utilizes smart contracts, has experienced an impressive Q1’23. According to BitcoinCasinos.com, the platform’s native token, XTZ, has seen a 56% quarter-over-quarter surge in its circulating market cap, now exceeding $1B. This growth is attributed to the platform’s innovative features and successful partnerships.

BitcoinCasino’s Financial expert Edith Reads commented on the findings saying, “The platform’s Liquid Proof of Stake consensus algorithm has enabled it to become one of the most energy-efficient networks on the market. This approach helps reduce the energy costs associated with running a blockchain network and helps maintain Tezos’ decentralized nature. Additionally, its on-chain governance feature allows for democratic decision-making regarding amending protocol parameters or deploying new features.”

Increase in Smart Contract Deployment

The increase in Tezos’ market cap can be attributed to several factors. For starters, the platform’s popularity has been on the rise due to its unique approach to governance. Unlike other blockchain platforms, Tezos allows its users to vote on changes to the protocol, giving them a voice in the platform’s evolution. This approach has resonated with many in the crypto community, leading to increased platform adoption.

Furthermore, Tezos has been making strides in the DeFi space, with several projects being built on the platform. DeFi, or decentralized finance, is a rapidly growing sector of the crypto industry that aims to provide financial services using blockchain technology. Tezos’ focus on governance and its ability to support smart contracts makes it an attractive platform for DeFi projects.

Its real-world use cases, such as those in gaming and digital art, have also been contributing to the platform’s success. The blockchain game Emergents is built on the Tezos network, allowing players to buy and trade unique in-game assets using XTZ. Similarly, platforms like Kalamint and Hic et Nunc allow artists to sell their digital artworks as non-fungible tokens (NFTs) using XTZ. These use cases demonstrate the platform’s versatility and potential for further adoption in the future.

Furthermore, with traditional financial institutions such as Société Générale using the Tezos chain for security token issuance, this could lead to an even larger increase in XTZ’s market cap as investors become more optimistic about the platform’s potential.

Future Potential

The impressive growth of Tezos’ market cap in Q1’23 demonstrates the platform’s potential for long-term success. Tezos has a formidable suite of features and a passionate community, both of which have been instrumental in its growth. The increasing adoption of the platform for use cases like gaming and digital art could further propel its price, potentially resulting in an even larger market cap by the end of the year. This suggests that Tezos may potentially be one of the leading cryptocurrencies to watch in the coming months and years.