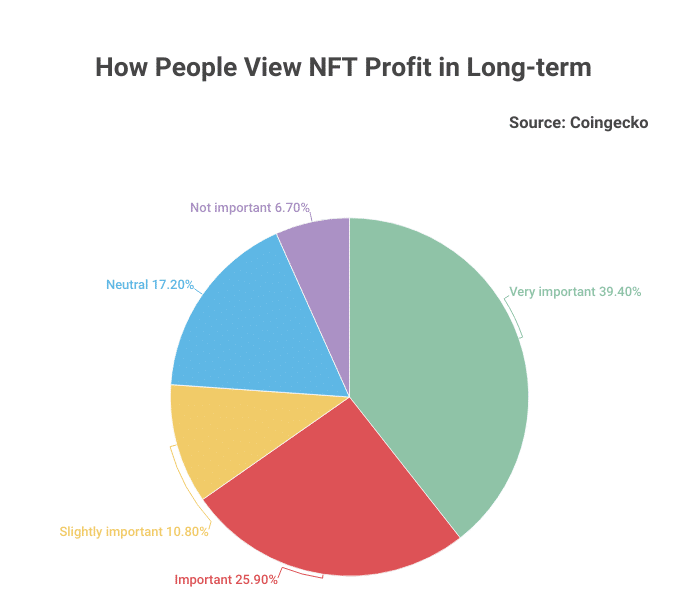

Non-Fungible Tokens (NFTs) have taken the world by storm, and along with their popularity, interest in them as a potential financial asset has also grown. Many people are investing in NFTs, not only for the unique digital assets but also for their potential long-term profit. According to an analysis by BitcoinCasinos.com, 39% of NFT buyers are motivated by the long-term profit factor.

BitcoinCasinos betting expert Edith Reads commented on the findings saying,” It appears that NFT buyers are quite savvy when it comes to their investments, carefully factoring in not only the utility of a given collection but also its potential resale value. As such, many NFT holders have been able to take advantage of this emerging market and turn a profit over time.”

The analysis also found that 3 out of 4 NFT holders consider how much utility a collection offers before buying. In addition, 68.8% of buyers said they purchase an NFT because they want to join the community, indicating that people are using their investments to support projects and ideas they believe in. Lastly, personal enthusiasm for both the business model and artwork of a collection were cited as equally important reasons to purchase.

Long-term Vision

Holding NFTs for an extended period can result in increased value depending on the digital asset. With increased demand and a decrease in supply, NFTs can become rare digital collectibles that are sought after by many. Long-term collecting also allows holders to store assets in a smart wallet, protecting them from the market.

This strategy is becoming increasingly popular amongst NFT buyers who aren’t necessarily interested in cashing out their investments but are more focused on building an impressive collection over time.

Why Holding NFTs For The Long-Term Matters

The potential to make a profit is an important factor in the decision to purchase When it comes to the long-term success of NFTs, what matters most is understanding the big picture and potential effects of digital assets. Warren Buffet famously said, “Our favorite holding period is forever.”

This could not be more true for Non-Fungible Tokens. Unlike Bitcoin and other crypto options with many variabilities impacting their value, NFTs become a safer bet when you understand the technology behind digital ownership. They are protected from market forces and provide stability for your investments over time.

Collectors who can focus on the long-term effects of non-fungible tokens can see clearly the potential of the technology and, more importantly, the success of their investments in the long run.

NFT collections with a better chance of succeeding, in the long run are those with strong communities, excellent utilities, and those who continue to deliver on their roadmaps. With these things in place, NFTs can become a safe and profitable investment for many years.