Stablecoin USDC wreaked havoc across the crypto markets when it lost its peg to the dollar earlier this month. But, as other stablecoins felt the effects of the de-pegging, DeFi seems to be riding on the opportunity to make its comeback.

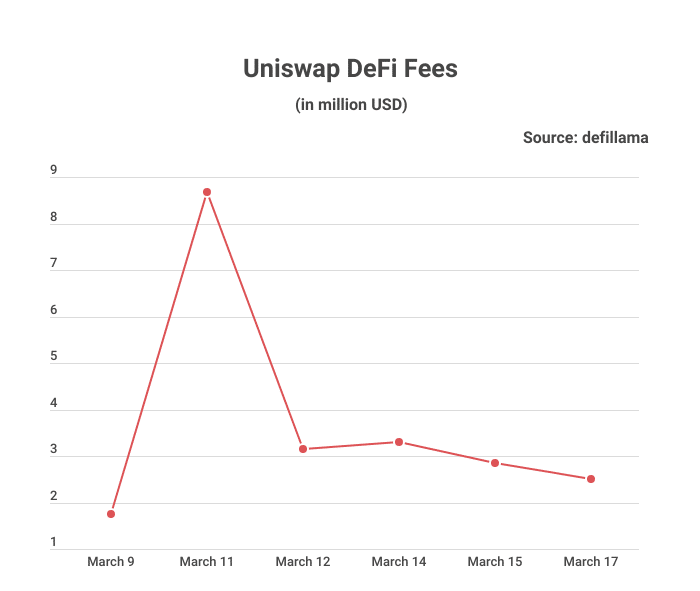

Analysis conducted by BitcoinCasinos.com revealed a spike in transaction fees on the DeFi platform, Uniswap. The permissionless DEX had its trading fees at $8.748 million on 11th March 2023, setting a new ATH.

While commenting on the spike, the research lead at the site, Edith Reads, had this to say. “USDC’s depeg caused panic, especially because of how things played out the last time a stablecoin went down the same road. Trading volumes spiked as holders rushed to swap their USDC tokens in case another LUNA disaster came up.”

Transaction fees on Uniswap are distributed among liquidity providers in proportion to the number of tokens staked.

Latest Uniswap Protocol is the Most Preferred Among Traders

Further research reports showed that many DEX traders prefer the latest version of the protocol, Uniswap V3.

On the same day, V3 registered most of the transaction fees on the exchange, totalling about $7.48 million. It is also the protocol with the highest average daily and weekly transaction fees at the time of press at $1.239M and $1.479M, respectively.

Uniswap V3, launched in May 2021, is more secure, decentralized, and capital efficient, making it a favourite choice for frequent traders.

Arbitrum One comes in second, while Uniswap V2 is the third highest in transaction fees on the DEX.

Markets Regain Optimism After USDC Regained its Dollar Peg

USD Coin lost its peg to the dollar following the collapse of the Silicon Valley Bank. The coin’s issuer, Circle, announced it had some $3.3 million deposited in the bank, sending shockwaves to the market and plummeting USDC to an all-time low of $0.87.

The depeg caused ripples as liquidity reduced dramatically. However, emergency measures by the US government to protect depositors in the SVB bank helped set the coin on its path to regaining its peg. Circle then announced the deposit it held in the bank would be available once the US banks were open. Further, it had chosen Cross River Bank as its new partner.

The corrective move helped improve market liquidity as more than $60 million was injected through the USDC- USDT pair on the Binance Exchange only.

At the time of writing, USDC is trading at $0.9988 on Coinmarketcap. However, Circle is still redeeming the coin at a 1:1 rate.