However, a recent analysis by Bitcoincasinos.com indicates that the total supply of DAI has dropped by 50% since its peak. This is primarily due to the declining prices of its underlying assets, which has caused a corresponding drop in the total supply of DAI.

Bitcoincasino.com betting expert commented on the data saying, ” Contraction in DAI supply is an example of the challenges MakerDAO has been facing since its inception. The project has had to constantly adjust its strategy to face various risks, including market volatility, capital inefficiency, and centralized points of failure. Despite all this, MakerDAO has remained afloat and continues to provide a valuable service within the DeFi community.”

Challenges Facing the Project

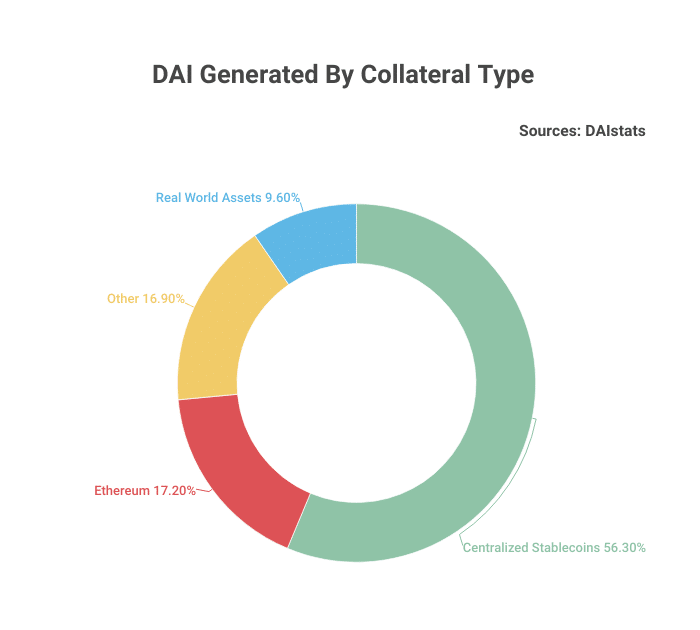

The sharp decline in the total supply of DAI can largely be attributed to MakerDAO’s Collateralized Debt Position (CDP) model, which allows users to generate the DAI stablecoin by collateralizing other cryptocurrencies, such as Ethereum. As the prices of its underlying assets continue to decrease, users are less likely to deposit their crypto as collateral to generate DAI.

This has caused a sharp contraction in the total supply of DAI, potentially leading to long-term challenges for MakerDAO if it is not addressed soon. The project must work to incentivize users to deposit their crypto assets as collateral and stabilize the prices of its underlying assets for the total supply of DAI to increase.

Lido Remains a Persistent Roadblock

Ethereum-based liquid staking platform Lido Finance has seized the crown of having the most Total Value Locked (TVL) in DeFi, overtaking MakerDAO. This is mainly due to the stability of its native token, $LDO, which has consistently increased in value since its launch.

It is clear that MakerDAO needs to step up its game to regain control over the DeFi ecosystem and keep up with the growing competition from Lido Finance. The project must find ways to reinvigorate the user base and encourage more users to deposit their crypto as collateral to generate DAI. This will be essential if MakerDAO wants to remain competitive in the DeFi space.