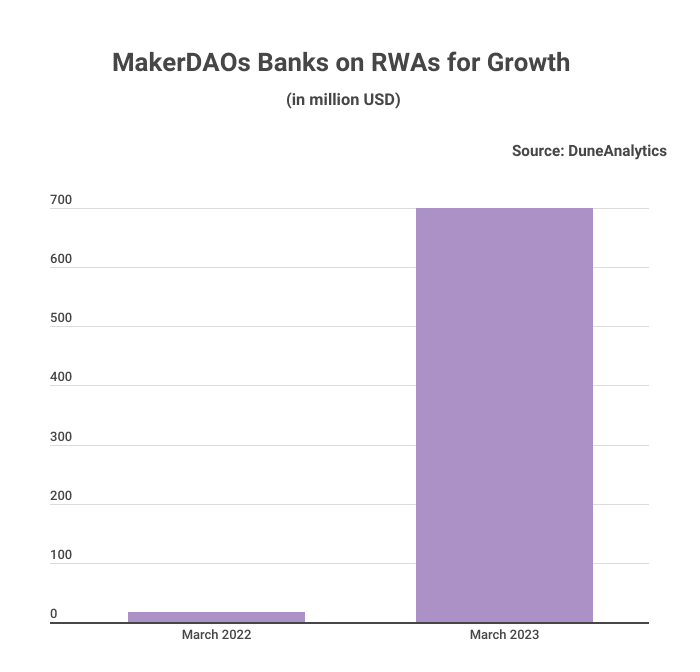

The finance world is in the midst of a revolution. The tokenization of real-world assets (RWA) is quickly gaining traction in the space, and MakerDAO is leading the charge. According to BitcoinCasinos.com, MakerDAO’s RWA value has increased significantly – a staggering 4000% growth from its initial value of $17 million to approximately $700 million.

According to BitcoinCasinos’ investments expert, Edith Reads, “The surge in MakerDAO’s RWA value is a significant milestone for the decentralized finance (DeFi) industry. It demonstrates the growing demand for those services and the potential for DeFi platforms to revolutionize traditional financial (TradFi) markets.”

She adds that through asset tokenization, MarkerDAO and other DeFi platforms provide users with an accessible, transparent, and efficient entry to financial services. This way, they challenge the status quo and open up new opportunities for people worldwide.

What’s Behind MarkerDAO’s Surging RWA Value?

The growth of MakerDAO’s RWA value can be attributed mainly to the fact that more and more people have started exploring DeFi solutions for earning passive income by collateralizing their digital assets. The associated benefits include lower costs, higher liquidity and improved market access compared with TradFi products.

Furthermore, the regulatory environment surrounding cryptocurrency and blockchain technology has improved significantly. Governments are setting clear rules regarding taxation and other legal issues related to digital currencies. As such, they’re making it easier for investors to trust these projects with their money.

Again, the surge in the RWA value shows how far DeFi innovation has come since its inception in 2017. Technology has evolved enough to make complex financial operations such as asset tokenization possible. There have also been considerable improvements in scalability, security and user experience that have helped to fuel investor confidence in these projects.

Implications of MarkerDAO’s Soaring RWA Value

The implications of these developments are far-reaching for both investors and the broader crypto landscape. For starters, increased adoption of DeFi projects will likely lead to further integration into TradFi systems.

That will allow investors access to new opportunities that have previously been out of reach due to high levels of risk or lack of liquidity options available on traditional exchanges.

Moreover, one of the most exciting aspects of MakerDAO’s RWA value growth is its potential to expand into new markets and use cases. For example, investors could use the platform to create stablecoins backed by real estate assets. This will make it easier for people to invest in property without the traditional barriers to entry.

Finally, the success of projects like MakerDao’s RWA tokenization system suggests that digital assets can hold their own against fiat currencies. They can be as effective in storing long-term wealth and providing consistent returns over time. That’s something that could potentially revolutionize the future of finance.