Monthly Active Users (MAU) is a crucial metric within the cryptocurrency sphere. It represents users’ adoption and engagement with a project or network. As such, this number can provide a sturdy validation (or lack thereof) of the crypto project. Higher MAUs often correlate with greater user adoption signifying the community’s confidence in the project.

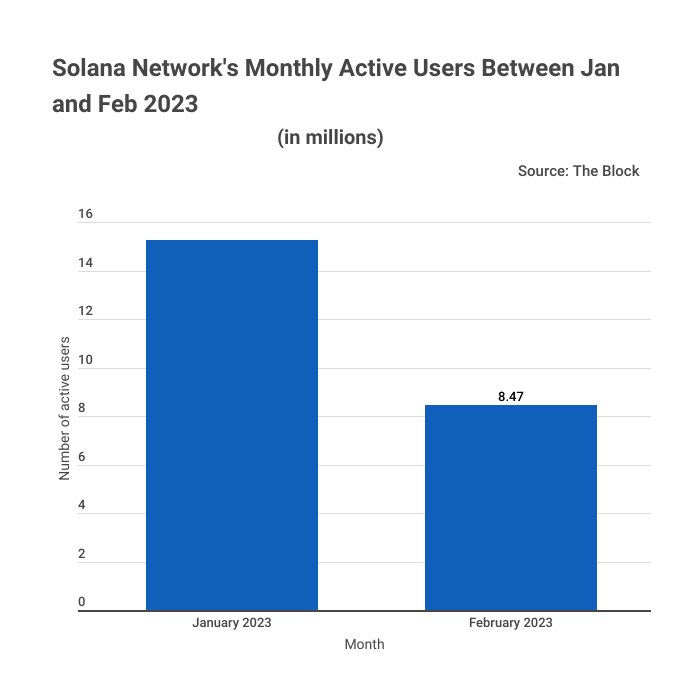

Solana (SOL) has been one of the leading blockchain networks, and its MAU shifts are closely monitored. But according to BitcoinCasinos.com, Solana’s MAU took a surprising dip in February this year. The site reports that Solana’s MAU nose-dived by 45% in February to stand at 8.47M from a high of 15.24M in January.

What Was Behind Sol’s Falling MAUs?

Edith Reads, an investment expert from BitcoinCasino, recently shared her thoughts on Solana’s declining MAU data in February. She attributes this decline to fudding within the SOL community following the network’s outages in the month. She asserts,

“You can’t delink Solana’s declining MAUs in February from the FUD that arose from the outages that affected the network then. Those made many investors second-guess their SOL investments hence their pulling back.”

Solana’s network disruptions have been a huge cause for concern for users and investors. Many have called into question SOL’s reliability and security following these interruptions. The network hasn’t explained what triggered those service failures giving rise to speculations.

Varied Reactions to SOL’s Downturn

The network’s recent downtimes had some people attributing the delays to flaws in its design. There were suggestions that Solana’s on-chain voting and governance structure was causing a bottleneck in the system hence the disruptions. However, Solana’s CEO Anatoly Yakovenko declared this idea “pure ignorance.”

Other commentators have suggested that multiple reasons could be behind SOL’s chaos. Yakolenko’s silence on what had caused the interruptions did little to illuminate the matter. Again, Solana Teams’ admission that they couldn’t adequately pinpoint what caused the outages only exacerbated this confusion.

Is Solana On the Rebound?

In the face of controversy, Solana has proven to be resilient. It recently reached the 500K mark in daily active unique addresses (DAU). According to one report, that surge was nine times greater than what it had plunged to on February 26th, 2023. That uptick saw SOL’s transaction fees grow by over 2000% to $51.1K.One possible reason behind the surge has been a rebounding of non-fungible tokens (NFT) transactional volumes on the network. According to a CryptoSlam report, SOL’s NFT sales have reached $2.8M from over 11,000 unique buyers at press time. That’s a nearly 22% surge compared to February 26th, when NFT sales were only at $2.3M with 7,233 unique buyers.