Digital wallets, also known as e-wallets, have become increasingly popular over the past decade as more people have shifted towards using digital forms of payment.

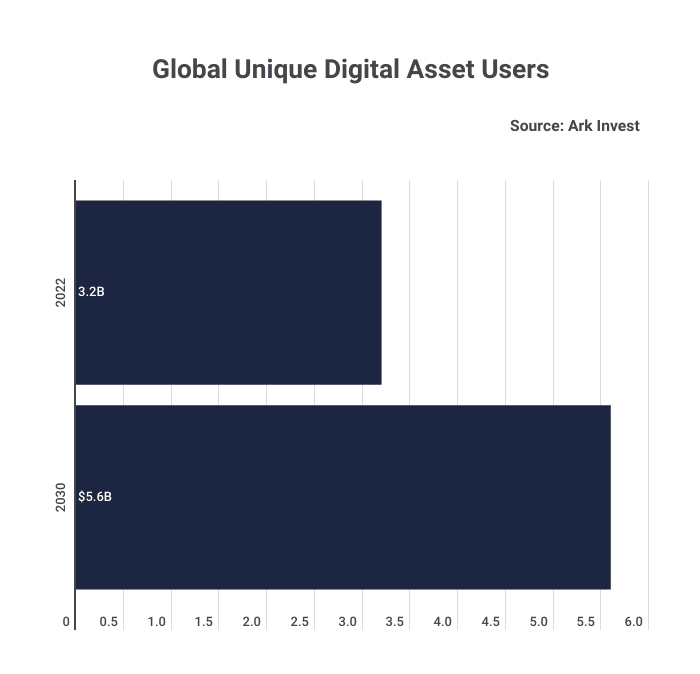

These wallets allow users to store and manage their money electronically, making transactions more convenient and secure. According to BitcoinCasinos.com, 65% of the global population is estimated to be using digital wallets by 2030. This would mean that more than 5.6 billion people will rely on digital wallets for everyday transactions.

BitcoinCasinos’ betting expert Edith Reads says: “Blockchain technology and cryptocurrencies have had a major impact on how people store, transfer, and spend their money. Digital wallets are becoming increasingly popular as they provide an efficient and secure way to store and manage money electronically.”

Factors Leading to the Increasing Popularity of Digital Wallets

The growth in digital wallet usage can be attributed to several factors. First and foremost, the convenience they provide cannot be overstated. Digital wallets allow users to make payments quickly and easily from their smartphones or other digital devices. They eliminate the need to carry cash or credit cards, which can be lost or stolen. In addition, digital wallets can store multiple forms of payment, such as credit and debit cards, and can be used to make payments at a wide range of merchants, both online and offline.

Another factor driving the growth of digital wallets is the increased focus on security. Digital wallets use encryption and other security measures to protect users’ financial information, reducing the risk of fraud and identity theft. Additionally, many digital wallets offer features such as two-factor authentication and the ability to remotely disable lost or stolen devices, further increasing the level of security.

Digital wallets also offer a high level of flexibility, allowing users to easily transfer money between accounts, make international payments, and split bills with friends or family. Some digital wallets even offer cashback rewards, discounts, and other incentives to encourage users to adopt and use the technology.

The growth of digital wallets is not limited to developed countries. Many developing countries are embracing the technology at an even faster rate. For example, in China, digital wallets have become the primary payment method for many consumers, with 45% of adults using the payment method daily and an additional 41% doing so at least once a week.

Challenges Facing Digital Wallets

However, there are still challenges to be overcome in the widespread adoption of digital wallets. One of the most significant barriers is the lack of universal acceptance. While many merchants now accept digital wallet payments, many still do not, particularly in less developed countries.

In addition, there are concerns over the security and privacy of financial data stored in digital wallets, which must be addressed in order to build trust and encourage adoption.

Despite these challenges, digital wallet usage will continue to grow in the coming years. As more people become comfortable with digital payments and security measures, improve, the number of users is expected to increase significantly by 2030.