In recent months, the crypto world has seen a significant shift in the balance of power among investors. Small investors, also known as retail holders, have taken a larger piece of the pie in the wake of the fall of LUNA, a popular cryptocurrency.

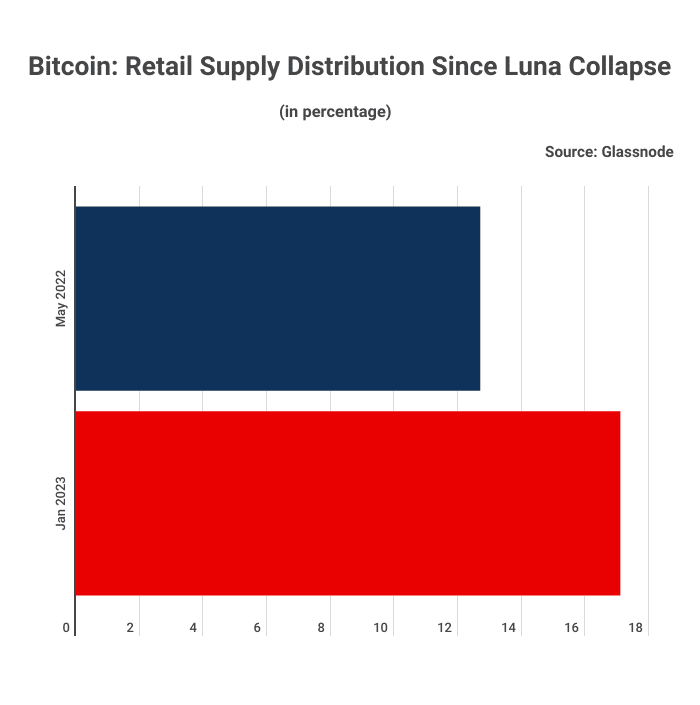

According to BitcoinCasino.com, retail holders now control 17.1% of the circulating supply of cryptos. A significant 4.4% increase over the past eight months.

Edith Reads, the BitcoinCasino investment expert, commented on the data. “The fall of LUNA presented a buying opportunity for small investors. They saw the potential for long-term gains despite the short-term setback. They preyed on discounted prices to accumulate more of the cryptocurrency. Thus, they increased their control over the circulating supply. This made them solidify their position as a significant player in the market.”

Retail Holders Are Keen on Opportunities

Cryptocurrency’s value plummeted faster, and Luna was a casualty. The token collapsed, causing many large investors to sell off their crypto holdings, fearing the fate of Luna could befall them. However, this downturn allowed small investors to enter the market and take control of a more significant portion of the circulating supply.

Many small investors see the fall of LUNA and the crypto winter as a temporary setback. They believe that the long-term potential of cryptocurrency remains strong. This winter allowed them to accumulate more tokens at a lower price.

They intend to hold on to it for a more extended period, expecting gains in the future.

Crypto Winter Opened the Doors for Small Investors

This is not the first time small investors have taken advantage of market downturns to increase their ownership in the crypto market. In the past, similar opportunities have presented themselves during market crashes. The crashes led to a shift in the balance of power among investors.

The fall of LUNA and other cryptos presented an opportunity for small investors to take control of a bigger part of the circulating supply.

While the market can be unpredictable, the long-term potential of cryptocurrencies remains attractive. Small-scale investors are willing to take on the risks associated with this volatile market.

However, it’s also important to note that investing in cryptocurrency is inherently risky. And prices may fall again. Investors need to understand the risks and make informed decisions about their investments.