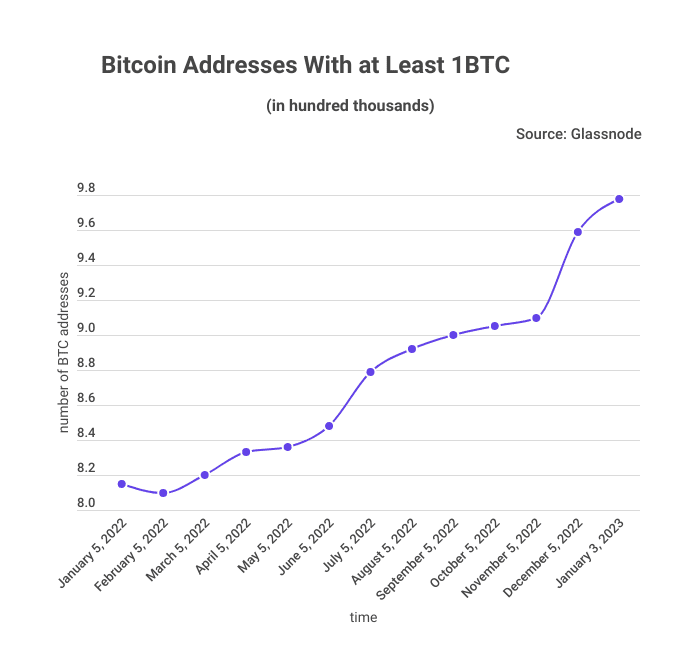

The number of addresses holding at least one Bitcoin (BTC) is on a growth trajectory and is quickly approaching the one million mark. According to a BitcoinCasinos.com report, addresses with a balance of at least 1BTC stand at 978,963, an all-time high. BTC addresses are an integral part of the Bitcoin ecosystem, and this growth underscores the crypto asset’s growing popularity among investors.

BitcoinCasinos’ investments expert Edith Reads, has offered her thoughts on this trend. According to her, this kind of growth signals a positive sentiment toward BTC investments. To her, this development signals wider adoption of the cryptocurrency, potentially driving its price and providing more stability for the entire crypto market.

She affirmed, “The increase in Bitcoin holdings of over one coin indicates how it has moved from being a niche investment to one more widely accepted by investors. And as it continues to gain in popularity, this trend will likely continue despite any short-term market volatility.”

So What’s Driving This Growth?

Several factors have contributed to this growth in Bitcoin address numbers. For starters, there’s been an increasing interest in the digital asset among institutional investors. This has seen them buying and holding it as part of diversifying their investment portfolios.

Additionally, the increasing awareness of cryptocurrencies among the public has led to more individuals buying and holding BTC for hedging or speculation. The increased adoption rate of cryptocurrencies has also contributed to this rise. Many businesses have started accepting BTC payments to give customers greater choices when paying for goods and services.

Moreover, various governments have begun exploring blockchain technology and its applications, adding further impetus to this trend. Some have also provided legitimacy to Bitcoin by introducing regulatory frameworks for its trading and use.

This shift has increased investor confidence when investing in BTC as it provides them with legal protections for their investments.

Implications on the Crypto Ecosystem

The growth in the number of Bitcoin addresses holding at least one BTC has far-reaching implications for the entire crypto ecosystem. As more people acquire BTC and invest in the space, it boosts liquidity which in turn gives greater stability to the market as a whole.

Additionally, this growth means more demand for services such as wallets, exchanges, and other related products, which further promotes innovation within the industry. Furthermore, it adds credence to the argument that cryptocurrencies are here to stay as a legitimate asset class with real-world applications beyond speculation or trading activity.

Additionally, increasing demand for these assets will inevitably lead to higher prices as buyers compete in a limited market.